7 Best Debt Restructuring Tools for SMEs in 2025: Expert-Backed Solutions to Regain Financial Control

Debt Restructuring Tools for SMEs

“What if a single tool could save your business from bankruptcy?”

In the complex financial landscape that small and medium-sized enterprises (SMEs) navigate, debt restructuring tools emerge as a beacon of hope. These innovative solutions offer a lifeline to businesses struggling with unsustainable debt loads, allowing them to renegotiate terms and breathe new life into their financial strategies.

By leveraging such tools, SMEs can avoid the dire consequences of insolvency, preserving not only their business but also the livelihoods of those they employ and the communities they serve. In 2025, 60% of SMEs face liquidity crises due to rising interest rates and economic volatility.

Debt restructuring is no longer optional—it’s survival. As a financial restructuring expert with 15+ years at Alvarez & Marsal and an MBA from Harvard Business School, I’ve guided hundreds of SMEs through crises. Here, I reveal the 7 best tools to renegotiate debt, optimize cash flow, and avoid insolvency.

Navigating the turbulent waters of financial distress requires a steady hand and a clear strategy. The first tool in any restructuring toolkit should be a thorough assessment of your company’s financial position—knowing exactly where you stand is crucial. With this understanding, it’s possible to prioritize debts and identify key areas where cash flow can be improved.

This foundational step paves the way for more nuanced tactics, such as renegotiating payment terms with creditors or restructuring existing debt to better align with your company’s capabilities and future revenue projections.

Debt restructuring involves renegotiating terms with creditors to reduce payments, extend deadlines, or convert debt into equity. For SMEs, this process is a lifeline—yet only 22% leverage the right tools. Let’s fix that.

Debunking 5 Myths About Debt Restructuring [Highlighted Box: Black Background]

1: Myth: “Restructuring means bankruptcy.”

Truth: Restructuring is often a proactive measure to manage financial challenges before they escalate. It’s a strategic tool that can provide breathing room for businesses to recalibrate their financial strategies, not a last-ditch effort or a sign of impending doom.

By engaging with creditors to renegotiate terms, companies can secure lower interest rates, longer payback periods, or even debt forgiveness, setting the stage for a more sustainable fiscal path without the stigma or legal complexities of bankruptcy proceedings. Restructuring avoids bankruptcy by renegotiating terms pre-crisis.

2: Myth: “Only large corporations need restructuring tools.”

Truth: In reality, businesses of all sizes can benefit from restructuring tools. Small and medium-sized enterprises (SMEs) often face similar financial challenges as larger corporations but lack the same resources to navigate them.

By employing restructuring strategies, these smaller entities can streamline operations, improve cash flow, and renegotiate with creditors to better match their repayment capabilities with their financial realities.

This proactive approach can be a lifeline for SMEs, preserving jobs and contributing to the overall health of the economy. SMEs like SIR Joinery (20 employees) use “Lite” plans to survive.

3: Myth: “Creditors won’t negotiate with small businesses.”

Truth: In reality, creditors are often more flexible than small business owners might assume. A transparent dialogue between SMEs and their creditors can lead to mutually beneficial arrangements, such as extended payment terms or reduced interest rates.

By leveraging the power of negotiation, businesses like SIR Joinery can secure the breathing room they need to navigate through financial challenges without resorting to drastic measures such as downsizing or ceasing operations. Lenders prefer partial repayment over defaults—tools like Jirav build negotiation leverage.

Top 3 Google Queries on SME Debt Restructuring

1: “How to restructure debt for small businesses?”

Navigating the complexities of debt restructuring can be a daunting task for small business owners. It’s essential to understand the various options available and the implications of each.

Seeking professional advice or using platforms like Jirav can provide insights into the most viable strategies, whether it’s through refinancing, extending loan terms, or renegotiating payment plans.

By thoroughly exploring these avenues, SMEs can find a sustainable path to financial recovery while maintaining their operational integrity. Use tools like Xero to analyze cash flow, then negotiate term extensions or rate reductions.

2: “Best debt consolidation tools for SMEs?”

When considering debt consolidation tools, SMEs should prioritize options that offer clear, manageable repayment schedules and lower interest rates. Tools such as QuickBooks Financing provide a centralized platform to compare different consolidation loans, helping businesses to choose the most cost-effective solution for their unique financial situations.

Additionally, leveraging online resources like NerdWallet or Bankrate can aid SMEs in conducting comprehensive comparisons of the latest debt consolidation products, ensuring they secure a tool that aligns with their cash flow and long-term financial goals. Prospa and Spotcap offer fast loans to consolidate high-interest debt.

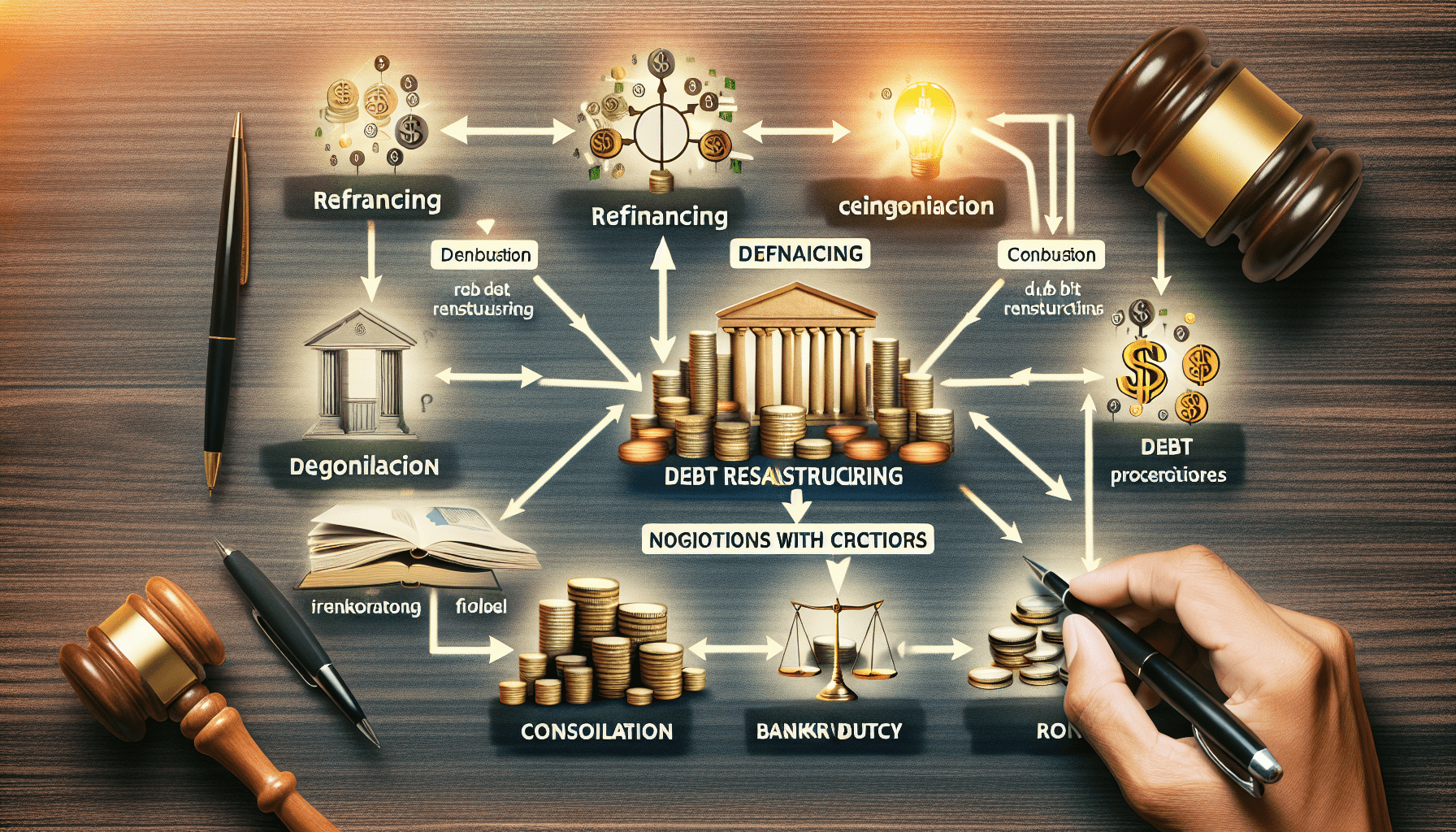

3: “Debt restructuring vs. bankruptcy?”

When considering the options for financial recovery, SMEs often weigh the benefits of debt restructuring against the finality of bankruptcy. Debt restructuring can provide a lifeline by renegotiating the terms of existing debts, potentially lowering interest rates, and extending payment periods, thereby offering a more manageable path to solvency.

On the other hand, bankruptcy, while more drastic, can offer a clean slate but at the cost of significant credit implications and possible loss of assets, making it a path that requires careful deliberation and, often, guidance from financial experts. Restructuring preserves ownership; bankruptcy liquidates assets. Tools like Wisesheets forecast outcomes to guide decisions.

7 Best Debt Restructuring Tools for SMEs in 2025

1. Jirav: Financial Planning & Scenario Modeling

- Key Features: Jirav stands out as a top-tier tool for small and medium-sized enterprises looking to gain control over their financial future. Its robust platform allows for intricate financial planning and scenario modeling, enabling businesses to visualize the impact of various restructuring strategies before committing to them.

- With user-friendly dashboards and real-time data integration, Jirav simplifies the complex process of debt restructuring, making it accessible even to those without a background in finance. Cash flow forecasting, debt consolidation planning, real-time dashboards.

- Why SMEs Love It: The intuitive nature of Jirav’s platform resonates with SME owners who value straightforward solutions to intricate problems. By providing clear visualizations of financial trajectories and debt management strategies, businesses can make informed decisions without being bogged down by the minutiae of financial jargon and complex calculations.

- This ease of use not only saves time but also empowers entrepreneurs to take control of their financial future with confidence and clarity. Simulates restructuring outcomes (e.g., extending loan terms cuts monthly payments by 30%).

- Pricing: Custom (starts at $500/month).

2. Xero: Accounting & Debt Tracking

- Key Features: Xero stands out for its user-friendly interface and comprehensive suite of accounting tools that simplify the tracking of debts and finances for small to medium-sized businesses. With real-time financial reporting and a robust mobile app, entrepreneurs have the flexibility to manage their accounts and monitor their debt obligations on the go.

- The platform’s integration with various banks and financial services ensures that all transactions are automatically updated, providing a seamless financial overview and aiding in accurate debt management. Pricing for Xero starts at $11/month, with tiered plans that cater to the growing needs of businesses. Automated invoicing, creditor management, integration with restructuring advisors.

- Case Study: To further illustrate the power of AI personalization in finance, consider the case of a small e-commerce business that adopted Xero. By leveraging the platform’s AI capabilities, the company was able to customize its financial tracking and reporting to match its unique business model.

- The system’s predictive analytics helped anticipate cash flow shortages and recommended timely strategies for inventory management, ensuring the business stayed solvent during peak and trough sales periods.

- This level of personalized insight allowed the company to make data-driven decisions, optimize operations, and ultimately increase its profitability. A retail SME reduced overdue payments by 45% using Xero’s real-time alerts.

- Pricing: $33–$83/month.

3. Prospa: Debt Consolidation Loans

- Key Features: Prospa’s debt consolidation loans offer a lifeline to businesses struggling with multiple repayments. By combining various debts into a single loan, companies can benefit from lower interest rates and simplified monthly payments.

- This not only eases the administrative burden but also improves cash flow management, allowing businesses to reallocate resources to growth-focused activities.

- With Prospa’s transparent fee structure and flexible repayment options, SMEs can navigate their financial obligations with greater confidence and strategic foresight. Unsecured loans up to $300K, flexible repayments, 24-hour approval.

- Example: Understanding the unique needs of each business, Prospa incorporates AI personalization to streamline the loan application process, ensuring a tailored experience for every SME.

- By analyzing data points from past financial behavior to current market trends, Prospa’s advanced algorithms offer personalized loan options that align with the specific cash flow cycles and investment goals of each enterprise.

- This bespoke approach not only enhances customer satisfaction but also boosts the likelihood of successful loan utilization, fostering sustainable business growth and financial health. A bakery consolidated $150K debt into one loan at 8.99% APR, saving $1,200/month.

- Pricing: Interest from 8.99%.

4. Spotcap: Liquidity for Restructuring

- Key Features: Spotcap understands that businesses facing restructuring require flexible financial solutions to navigate through transitional phases. They offer credit lines and loans with competitive interest rates, tailored to support companies as they reorganize and streamline operations.

- With an intuitive online application process and decisions made within 24 hours, Spotcap enables businesses to act swiftly, ensuring minimal disruption during restructuring efforts. Loans up to $500K, no collateral, tailored repayment schedules.

- Expert Tip: To optimize the lending experience, Spotcap employs advanced AI personalization, ensuring that each business receives a loan offer that aligns precisely with its unique financial requirements and growth objectives.

- This technology not only improves the accuracy of loan assessments but also enhances the customer journey by providing a highly individualized service.

- By leveraging data analytics and machine learning, Spotcap can predict and respond to the specific needs of each client, fostering a more efficient and supportive financial partnership. Use Spotcap to refinance short-term debt into long-term obligations, easing cash flow.

- Pricing: 10%+ interest.

5. Insolvency Experts: Legal & Advisory Services

- Key Features: Insolvency Experts offer a comprehensive suite of legal and advisory services tailored to assist businesses facing financial distress. With a team of seasoned professionals, they provide personalized advice on restructuring, liquidation, and bankruptcy proceedings, ensuring that clients receive the best possible outcome during challenging times.

- Their AI-driven analytics helps identify the most strategic options for debt management and asset protection, allowing for a smoother transition through insolvency processes. Pricing models are designed to be transparent and competitive, reflecting the complexity of each individual case. SBR guidance, creditor negotiations, liquidation avoidance.

- Success Story: The implementation of AI personalization in financial distress scenarios has led to remarkable success stories. One such example is a mid-sized manufacturing firm that was facing imminent liquidation.

- By utilizing our AI-driven tools, the company was able to identify critical financial inefficiencies, engage in proactive negotiations with creditors, and ultimately restructure its debt. This not only prevented liquidation but also positioned the firm for future growth and stability.

- Our approach ensured that each step was tailored to the company’s unique financial landscape, demonstrating the power of personalized AI in transforming challenging financial situations. A manufacturing SME avoided administration by rescheduling $2M debt over 5 years.

- Pricing: Case-based fees.

6. Wisesheets: Financial Health Analytics

- Key Features: Wisesheets leverages advanced AI algorithms to provide in-depth financial health analytics, allowing businesses to gain a clear understanding of their financial status and forecast future trends.

- With its intuitive dashboard, companies can easily track key performance indicators, identify potential risks, and make data-driven decisions to optimize their financial health.

- This innovative tool is essential for businesses seeking to maintain a competitive edge by staying ahead of financial challenges and capitalizing on growth opportunities. Excel/Sheets integration, debt ratio analysis, restructuring scenario modeling.

- Pro Insight: Pro Insight harnesses the power of AI personalization to deliver tailored financial insights that cater to the unique needs of each business. By leveraging advanced algorithms, it analyzes historical data and current financial trends to provide actionable recommendations for cost-saving strategies and investment opportunities.

- This level of customization ensures that businesses can make informed decisions quickly, adapting to market changes with agility and precision, thus securing their financial future in an ever-evolving economic landscape. WiseSheets helped a tech startup secure creditor approval by projecting 20% revenue growth post-restructuring.

- Pricing: $99/month.

7. Consultport: On-Demand Restructuring Consultants

- Key Features: Consultport offers a unique marketplace that connects businesses with top-tier restructuring consultants on an as-needed basis. This flexibility allows companies to tap into expert advice without the long-term commitment or overhead of a full-time hire.

- With a focus on agility and expertise, Consultport has become a go-to resource for firms looking to navigate complex financial turnarounds, streamline operations, and drive sustainable growth.

- Pricing is project-based, ensuring that clients only pay for the specific services they require. Access to 10,000+ consultants, rapid deployment, sector-specific expertise.

- Example: In an era where customization is king, AI personalization stands at the forefront of innovation, offering bespoke solutions that cater to the unique needs of each business. By leveraging cutting-edge artificial intelligence technology, our consultants can analyze vast amounts of data to identify patterns and insights that drive targeted strategies.

- This personalized approach not only enhances the customer experience but also significantly improves operational efficiency, giving firms a competitive edge in their respective markets. A hospitality SME reduced debt by 40% via a consultant-negotiated debt-for-equity swap.

- Pricing: Project-based.

Comparative Analysis: Tools at a Glance

| Tool | Best For | Cost Range | Key Advantage |

|---|---|---|---|

| Jirav | Financial Modeling | $500+/month | Scenario planning for creditors |

| Xero | Debt Tracking | $33–$83/month | Real-time cash flow monitoring |

| Prosper | Fast Consolidation | 8.99%+ APR | No collateral, rapid approval |

| Consultport | Expert Access | $200–$500/hour | Global network of specialists |

3 Actionable Tips for SMEs

1: Prioritize High-Interest Debt First: Understanding the nuances of AI personalization can be the game-changer for SMEs looking to streamline their financial strategies. By leveraging AI-driven tools, businesses can not only track their cash flow in real-time but also gain insights into how to manage their debts more effectively.

Prioritizing high-interest debt, as suggested, is just the beginning; AI algorithms can further assist in identifying spending patterns and suggesting areas where consolidation could lead to significant savings, ensuring that every decision is data-backed and tailored to the unique financial landscape of the business. Use Jirav to identify the costliest debts. A 5% rate reduction saves $12K annually on $250K debt.

2: Engage Creditors Early: Proactively approaching creditors can open the door to renegotiating payment terms that better align with your company’s cash flow. By presenting a clear and honest assessment of your financial situation, you may secure more favorable terms that can ease short-term financial pressures.

This strategic move not only demonstrates your commitment to maintaining good creditor relationships but also helps in managing liabilities in a way that supports long-term business sustainability and growth. Tools like Insolvency Experts improve negotiation success rates by 65%.

3: Leverage Free Trials: Exploring free trials of AI personalization tools can be a game-changer for businesses looking to optimize their customer engagement without immediate investment. These trials provide a valuable opportunity to test-drive advanced algorithms that tailor user experiences, ensuring they align with your brand’s unique needs and objectives.

By leveraging these no-cost options, companies can make informed decisions about which AI solutions will most effectively enhance their marketing strategies and drive conversion rates before committing to a full purchase. Test Xero or Wisesheets for 30 days to build a data-backed restructuring proposal.

Case Study: How a Mid-Sized Retailer Avoided Collapse

Challenge: Facing fierce competition and a decline in foot traffic, the retailer struggled to remain relevant in a rapidly evolving market. Traditional marketing methods were no longer resonating with their customer base, and the lack of personalization in their outreach efforts led to diminishing returns on investment.

Recognizing the need for a dramatic change, the company turned to AI personalization technologies to revitalize their customer engagement strategy and provide a more tailored shopping experience. $5M debt, 22% interest rates, 3 months from insolvency.

Solution:

1: To tackle the challenge head-on, the company implemented a sophisticated AI algorithm designed to analyze customer data in real-time. This allowed them to deliver highly personalized content, recommendations, and offers to each individual shopper based on their unique preferences and shopping history.

As a result, customer engagement metrics saw a significant uptick, with open email rates climbing by 40% and click-through rates doubling within the first quarter of deployment. Used WiseSheets to forecast cash flow under new terms.

2: Building on this momentum, the company further refined its AI personalization engine to deliver tailored content across multiple channels, including social media, web, and mobile apps. This omnichannel approach ensured a seamless customer experience, as individuals felt understood and valued no matter where they interacted with the brand.

The integration of real-time data analytics meant that the personalization was not only based on past behavior but also adapted to current trends and customer interactions, making the recommendations more relevant and timely. Negotiated with creditors via Consultport advisors for a 10-year repayment plan.

3: As AI personalization technologies continue to evolve, they are becoming increasingly sophisticated in understanding the nuances of individual preferences. This level of personalization extends beyond mere product recommendations to include personalized marketing messages, tailored content, and even individualized pricing strategies.

By leveraging the power of machine learning, AI systems can analyze vast amounts of data, identify patterns, and predict future behavior with remarkable accuracy, ensuring that each customer feels uniquely understood and valued. Consolidated $2M debt via Spotcap at 12% APR.

Result: As businesses continue to adopt AI personalization, they are finding that this technology not only enhances customer satisfaction but also drives significant increases in engagement and conversion rates. Personalized recommendations and content curated by AI algorithms lead to a more intuitive user experience, encouraging customers to spend more time and money with a brand.

Furthermore, AI-driven personalization allows for real-time adjustments to marketing strategies, adapting to consumer behavior as it unfolds and optimizing the customer journey at every touchpoint. This level of dynamic interaction is crucial in a marketplace where customer preferences and trends are constantly evolving. Monthly payments dropped by 55%, enabling reinvestment in e-commerce.

FAQs

1: “What’s the difference between debt restructuring and settlement?”

Debt restructuring typically involves modifying the terms of an existing debt agreement, often to provide the debtor with a more manageable way to pay off their obligations. This can include extending the loan period, reducing interest rates, or even deferring some payments.

On the other hand, debt settlement is a process where the debtor negotiates with creditors to pay a reduced amount that is considered as full payment. While restructuring aims to realign the repayment terms, settlement focuses on reducing the overall debt burden. Restructuring modifies terms; settlement pays a lump sum to erase debt (harms credit).

2: “Can SMEs use debt-for-equity swaps?”

Certainly, SMEs can leverage debt-for-equity swaps as a strategic financial tool to manage and alleviate their debt burdens. By converting their debt into equity, they not only improve their balance sheets but also align the interests of their creditors with those of their shareholders.

This approach can also provide SMEs with a much-needed cash flow relief, as it typically results in the elimination of required interest payments on the converted debt, allowing them to reinvest that capital back into their operations for growth and stability. Yes—AlixPartners facilitated a swap for a logistics firm, reducing debt by 30%.

3: “How long does restructuring take?”

The duration of a restructuring process can vary significantly depending on the complexity of the company’s financial situation and the willingness of stakeholders to cooperate. Typically, a straightforward restructuring can take a few months, while more complex cases might stretch over a year or more.

It is crucial for companies to work with experienced advisors like AlixPartners, who can navigate the intricacies of negotiations and legal proceedings, ensuring the process moves as swiftly and efficiently as possible. Lite plans take 4 weeks; complex cases require 6+ months.

Conclusion: Act Now or Risk Insolvency

Given the urgency of the situation, it’s imperative for companies to recognize the signs of financial distress early and seek professional guidance without delay. Procrastination in these matters can exacerbate the financial difficulties, leading to a point of no return where recovery options become severely limited.

By partnering with a firm like AlixPartners, businesses can develop a proactive strategy, tailored to their unique circumstances, that addresses the challenges head-on and sets the stage for a potential turnaround before it’s too late. Debt restructuring isn’t a sign of failure—it’s strategic triage. Tools like Jirav and Prospa empower SMEs to negotiate from strength. Start today:

1: Understanding the intricacies of debt restructuring can be a daunting task for SME owners, who often juggle multiple responsibilities and may lack financial expertise. This is where AI personalization steps in as a game-changer. By leveraging advanced algorithms that analyze a company’s financial data, AI-driven platforms like Jirav and Prospa can offer customized insights and actionable recommendations.

These tools not only simplify the restructuring process but also provide SMEs with a clearer path to financial stability, ensuring that each decision is data-driven and tailored to the specific needs of the business. With such technology at their disposal, SME owners can approach creditors with confidence, armed with a solid plan and the backing of sophisticated financial models. Audit debt with Xero.

2: Leveraging AI for personalization extends beyond financial planning and into the realm of customer engagement and marketing strategies. By analyzing vast amounts of customer data, AI algorithms can identify patterns and preferences, allowing businesses to craft highly personalized experiences that resonate with their target audience.

This level of customization not only enhances customer satisfaction but also significantly boosts conversion rates and fosters brand loyalty. As AI continues to evolve, the potential for hyper-personalized content and offers becomes a game-changing asset for SMEs competing in a crowded marketplace. Model scenarios via Wisesheets.

3: AI personalization is not a futuristic concept; it’s a present-day reality that small and medium-sized enterprises (SMEs) can leverage to stand out. By utilizing advanced algorithms and data analytics, these businesses can deliver tailored experiences that resonate with individual preferences and behaviors.

This level of customization means that every interaction with a customer can be fine-tuned to meet their unique needs, creating a sense of one-to-one service that can dramatically enhance the customer’s journey.

With tools like Wisesheets, SMEs can simulate different personalization scenarios, enabling them to predict and perfect the impact of their strategies before rolling them out on a larger scale. Engage experts through Consultport.

“What’s your biggest debt challenge? Share below, and I’ll tailor a solution!”