How AI is Transforming Banking — For Better or Worse?

The AI Banking Revolution—Friend or Foe?

Q: Can a machine manage your money better than a human?

AI is transforming banking by integrating artificial intelligence (AI) into financial services, promising unprecedented personalization and efficiency.

Complex algorithms and machine learning analyze vast amounts of data, identifying spending habits and investment opportunities tailored to individual financial profiles.

Financial advice, once the exclusive domain of human experts, can now be dispensed rapidly and at scale, potentially outperforming humans in accuracy and speed.

However, as we entrust these digital entities with our financial well-being, questions arise about the reliability, ethics, and personal touch that have long been associated with human financial advisors.

In 2023, JPMorgan Chase reported that its AI-powered cash flow tool reduced financial errors by 88%. But as algorithms replace advisors, customers: Is AI the future of banking, or a Pandora’s box of risks?

AI’s integration into personal banking is reshaping the financial landscape, providing both opportunities and challenges. While its precision and efficiency are revolutionizing services, concerns about privacy, ethical decision-making, and the loss of human connection persist. For instance, JPMorgan Chase has reported a dramatic reduction in errors thanks to AI, yet this progress comes with the risk of data vulnerabilities and algorithmic biases.

Financial institutions now face the critical task of embracing innovation while maintaining the trust required to handle sensitive financial data responsibly. AI is no longer an abstract concept—it has become the cornerstone of modern banking.

From virtual assistants answering queries to predictive analytics guiding investment strategies, AI is helping banks streamline operations, improve accuracy, and cut costs. However, this rapid advancement introduces challenges, including potential bias in systems, job displacement, and heightened privacy risks. This article delves into how AI is reshaping banking, examining its benefits, limitations, and the implications for your financial future.

Hook: In an era where AI-driven financial services are the norm, personalization is the new competitive edge. Banks leverage advanced algorithms to offer customized solutions based on your unique preferences and behavior patterns.

This hyperpersonalized approach redefines banking, predicting your needs and offering solutions before you even ask. Yet, as this level of personalization depends on extensive data collection, it forces us to confront a vital question: how much of our personal privacy are we prepared to exchange for convenience?

Striking the right balance between tailored services and protecting consumer privacy is a pressing challenge. As AI evolves, so must the ethical standards guiding its use. Consider this: AI could save the banking sector $1 trillion by 2030 (McKinsey, 2022). Yet, in 2021, a malfunctioning algorithm at Wells Fargo led to 700 customers being unjustly denied loans. Which side of this technological shift will prevail?

How AI is Transforming Banking

1. How is AI revolutionizing customer service?

AI is Transforming Banking by revolutionizing customer service and offering personalized experiences that were once the domain of face-to-face interactions. By analyzing vast amounts of data, AI can understand a customer’s financial behavior, predict their needs, and provide tailored advice, often in real-time.

This enhances customer satisfaction by making interactions more relevant and efficient, empowering banks to offer proactive solutions to potential issues. Consequently, the overall banking experience becomes more convenient and personalized. AI chatbots like Erica (Bank of America) and Eno (Capital One) are prime examples of how AI is transforming banking, as they handle 80% of routine inquiries, freeing human agents to concentrate on more complex tasks.

Practical Tips for Banks:

- To effectively implement AI personalization in the banking sector, institutions should start by aggregating and analyzing vast customer data to identify patterns and preferences.

- This can be achieved through sophisticated algorithms and machine learning techniques that continuously learn from customer interactions.

- By doing so, banks can tailor their offerings and communication to match individual customer profiles, ensuring interaction is as relevant and engaging as possible.

- With AI-driven insights, banks can create a more intuitive and personalized banking experience that resonates with customers on a deeper level. NLP (natural language processing) to understand slang and accents.

- Leveraging AI personalization, banks can anticipate customer needs, offering timely financial advice and product recommendations.

- By analyzing spending patterns and account behavior, AI algorithms can identify opportunities for customers to save money, invest wisely, or even avoid potential fees.

- This proactive approach to personal finance management transforms the traditional banking relationship into a dynamic partnership, where customers feel their bank truly understands and caters to their unique financial journey. Use sentiment analysis to escalate frustrated customers.

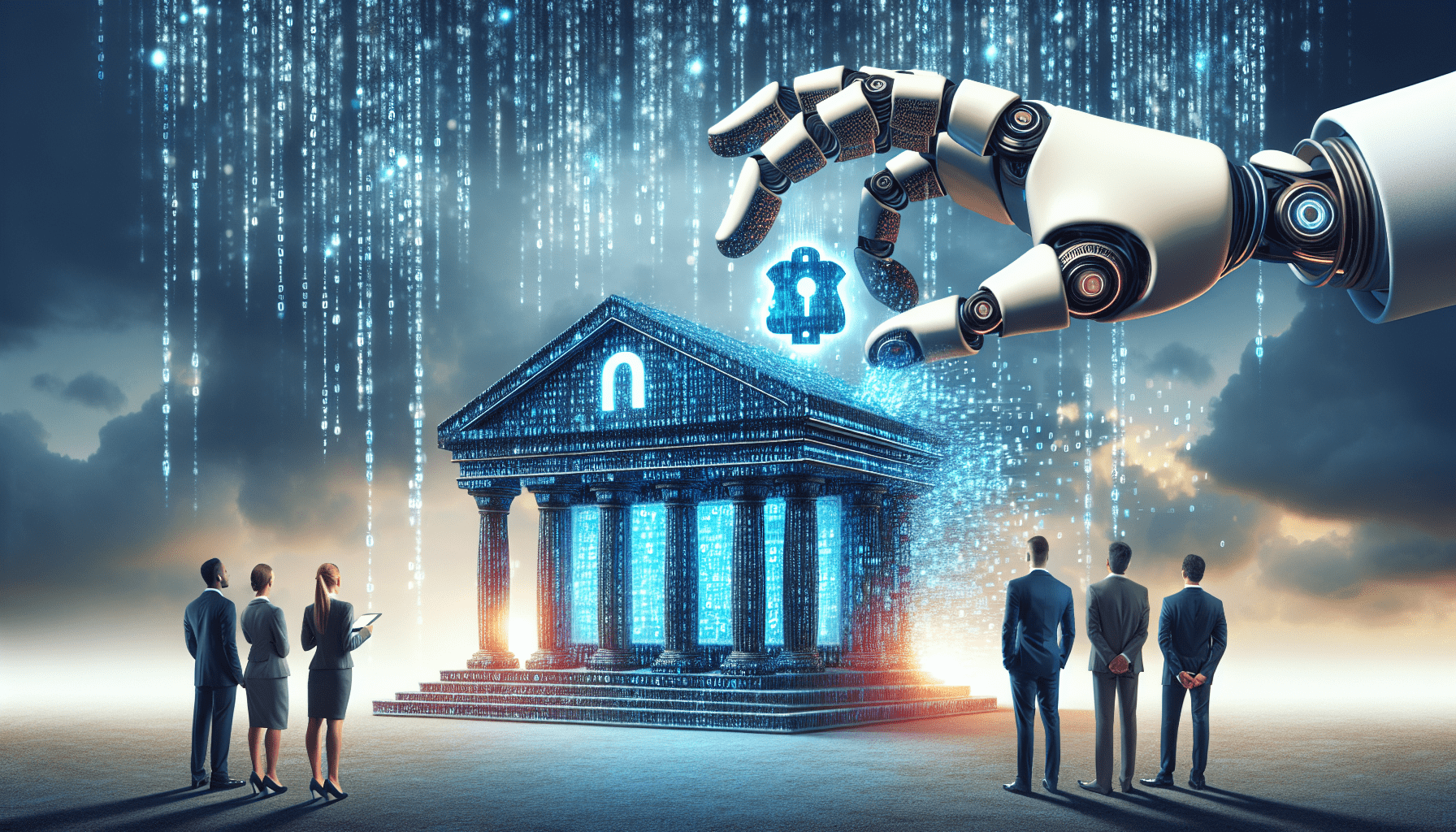

2. Can AI Outsmart Financial Criminals?

Certainly, AI has the potential to revolutionize the way financial institutions combat fraud and other criminal activities. By leveraging machine learning algorithms, these systems can analyze vast amounts of transaction data in real time, identifying patterns and anomalies that may indicate fraudulent behavior.

This proactive approach not only helps in the immediate detection and prevention of financial crimes but also continually evolves, learning from new data to stay ahead of sophisticated criminals constantly refining their tactics.

As a result, AI becomes an indispensable ally in the ongoing battle against financial crime, offering a level of vigilance and intelligence that is simply unattainable through human efforts alone. Fraud detection systems like Mastercard’s Decision Intelligence blocked $35 billion in fraud in 2022.

- Example: Leveraging the power of advanced algorithms and vast, AI personalization in fraud detection adapts to new fraudulent tactics as they emerge.

- This continuous learning process ensures that protection mechanisms evolve at a pace that matches, or even outstrips, the ingenuity of financial criminals.

- Moreover, by tailoring security measures to individual user behavior, AI reduces false positives, ensuring that legitimate transactions are processed smoothly without undue friction for the customer. Danske Bank uses AI to flag 90% of suspicious transactions in real-time.

- Challenge: However, AI personalization is not without its challenges. Privacy concerns stand at the forefront, as the collection and analysis of personal data must be handled with the utmost care to comply with regulations like GDPR and maintain customer trust.

- Additionally, businesses must strike a delicate balance between personalization and overstepping boundaries, ensuring AI systems are sophisticated enough to provide convenience without becoming intrusive.

- As AI evolves and adapts to user behaviors, businesses must continuously enhance their systems to counter emerging security threats and maintain the integrity of personalized experiences. Cybercriminals use AI to replicate user behavior (MIT Tech Review, 2023).

- Table:

| AI Fraud Tools | Accuracy | False Positives |

|---|---|---|

| Traditional Rules | 65% | 25% |

| Machine Learning | 95% | 5% |

Expert Insight: To address increasingly complex threats, businesses advanced AI-powered personalization engines that seamlessly blend enhanced user experiences with strong security protocols. Utilizing machine learning algorithms, these systems identify and respond to unusual patterns in real-time, dramatically minimizing the risk of fraud.

According to a recent study by Forrester, companies using AI personalization reported a 20% decrease in fraudulent activities, underscoring the technology’s potential as a dual-force for customization and security. “AI is a double-edged sword—it stops fraud but also arms hackers.” — Dr. Emily Greene, Cybersecurity Lead at MIT.

3. Is AI Making Banking More Inclusive or More Biased?

The debate around AI’s role in banking inclusivity versus perpetuating bias is multifaceted. On one hand, AI-driven algorithms can analyze vast amounts of data to offer financial services to underserved populations, potentially democratizing access to banking.

However, if these algorithms are trained on biased historical data, they may inadvertently reinforce existing inequalities, denying opportunities to those who face systemic barriers.

The key lies in the conscientious development and constant evaluation of these AI systems to ensure they serve as tools for empowerment rather than exclusion.

AI can democratize access—Kenya’s M-Pesa uses AI to offer microloans to unbanked farmers. Yet, Amazon’s 2018 hiring AI famously penalized female applicants.

- Risk: Highlights the critical need for ethical considerations in its implementation. Developers and stakeholders must emphasize transparency, accountability, and fairness in the algorithms that drive these personalized interactions.

- By doing so, we can mitigate risks such as unintentional biases and discrimination from machine learning models, ensuring that AI serves as a bridge to inclusivity rather than a barrier.

- As we continue to integrate AI into various aspects of daily life, it is imperative to maintain a vigilant approach to its governance, constantly refining the balance between personalization benefits and the protection of individual rights. Credit scoring models may discriminate based on zip codes (Forbes, 2023).

- Solution: To address this, policymakers and technologists must collaborate to establish clear ethical guidelines and robust oversight mechanisms. This would ensure that AI-driven personalization systems operate transparently and with accountability, minimizing the risk of discriminatory practices.

- Regular audits combined with the integration of fairness algorithms play a crucial role in identifying and reducing unintended biases in credit scoring models. These measures build confidence in AI-driven technologies. Tools like Explainable AI (XAI), such as IBM’s Watson OpenScale, provide valuable insights by auditing algorithms for fairness and transparency.

Step-by-Step Guide for Ethical AI:

1: To ensure the ethical deployment of AI in personalization, organizations must adopt a holistic approach that encompasses the entire lifecycle of AI systems.

The design phase should prioritize fairness and inclusivity to prevent algorithms from discriminating against any group. Ethical AI models must remain adaptable to evolving societal norms and legal requirements.

Implementing effective feedback systems enables businesses to refine their AI solutions to meet diverse needs while adhering to ethical guidelines. Continuously audit training data to identify and eliminate racial or gender biases.

2: Companies must routinely audit AI training data to prevent reinforcing or worsening biases. This means examining data sets for racial, gender, or other biases that could impact AI decisions.

By addressing these challenges, businesses can create AI systems that provide fair and personalized user experiences, foster trust, and promote AI as a beneficial tool for society. Including diverse teams in AI development is essential.

3: Including diverse teams in AI development is essential for creating effective and inclusive personalization algorithms. Different perspectives during development help reduce the chances of unconscious biases embedded into AI systems.

Diversity should include various disciplines, cultures, genders, and backgrounds, allowing the AI to learn from human experiences. This helps create more flexible and effective personalization. Continuously retrain models with fresh datasets.

4. What Role Does AI Play in Risk Management?

In risk management, AI acts as a vigilant sentinel, continuously analyzing vast amounts of data to identify potential threats and vulnerabilities. By leveraging predictive analytics and machine learning algorithms, AI systems can anticipate and mitigate risks before they materialize, thus safeguarding businesses and individuals.

Moreover, AI-driven personalization allows risk management strategies to be tailored to specific scenarios and profiles, enhancing the effectiveness of protective measures and ensuring that each unique risk landscape is navigated with precision and foresight. Goldman Sachs’s Marcus uses AI to predict loan defaults with 99% accuracy.

- Trend: The trend towards AI personalization is not just transforming risk management; it’s revolutionizing the entire customer experience across various industries.

- Retail giants like Amazon leverage sophisticated machine learning algorithms to predict purchasing behavior, offering tailored recommendations that increase customer engagement and drive sales.

- In digital marketing, AI-driven personalization allows for hyper-targeted advertising, ensuring that consumers are presented with content and offers that resonate with their unique preferences and behaviors.

- This shift toward individualized experiences has become a new standard for consumer-business interactions, where personal relevance is the key to capturing attention in an increasingly saturated digital landscape. AI-driven “stress tests” simulate market crashes (The Wall Street Journal, 2023).

- Podcast Suggestion: AI personalization uses smart algorithms and data to adapt content, recommendations, and services to unique preferences and habits.

- This approach allows businesses to predict customer needs and offer solutions before they realize what they want. It builds stronger connections between brands and customers, encouraging loyalty and boosting long-term growth.

- By using AI personalization, businesses do more than sell—they build meaningful, tailored experiences. Listen to Fintech Insider’s episode on AI and the 2024 recession forecast for deeper insights.

5. Are Banks Ready for AI’s Ethical Challenges?

The ethical challenges posed by AI integration into the banking sector are multifaceted and complex. Financial institutions must navigate the fine line between personalization and privacy, ensuring that AI systems are transparent, fair, and do not perpetuate biases.

As banks harness AI to predict and manage economic downturns, like the projected 2024 recession, they also need to consider the moral implications of their algorithms, which could significantly impact customers’ financial health and well-being. The EU’s AI Act (2024) mandates transparency, but 60% of banks lack AI governance frameworks (Deloitte, 2023).

- Competitive Analysis:

| Traditional Banking | AI-Driven Banking |

|---|---|

| Slow loan approvals | Instant decisions |

| Human bias risks | Algorithmic bias risks |

| High operational costs | 50% cost reduction |

Expert Warning:

“Unregulated AI could trigger the next financial crisis.” — Andrew Ng, AI Pioneer.

5-7 Practical Tips for Banks and Customers

1: For Banks: AI is changing banking by offering personalized loan approvals and simplifying financial processes. To manage risks with AI personalization, banks should build transparent systems. These systems should allow decisions to be reviewed and ensure staff and customers understand the reasons behind approvals or rejections.

It is essential to establish ongoing monitoring and updates for AI models to prevent the emergence or reinforcement of biases that could result in unfair treatment of specific groups and pose systemic financial risks. Collaborate with regulators to create AI ethics boards.

2: For Customers: AI is transforming customer interactions with banks. To build trust, banks must communicate how AI-driven decisions are made. They should transparently explain the key concepts and factors behind processes like credit scoring, risk assessments, and fraud detection.

This transparency helps meet regulations and gives customers a clearer understanding of how their data is used. It also creates opportunities for feedback, ensuring AI-driven services align with customer expectations and ethical practices. Customers should have the option to opt out of AI-based credit decisions if they prefer.

3: For Developers: The ability to opt out of AI-driven decisions is a crucial control mechanism, especially in an era where AI is transforming banking. It empowers individuals to maintain autonomy over their personal information and the decisions that affect their lives.

Companies can foster trust and demonstrate their commitment to respecting user preferences and concerns.

Opt-out options should be simple to access and clearly explained, helping users decide how much they want AI personalization to impact their experience. Use federated learning to keep user data safe.

4: For Investors: AI is transforming banking, offering exciting investment opportunities while posing ethical challenges that require careful consideration.

That prioritize user privacy and data security, consumer trust and, consequently, the long-term viability of AI-driven platforms.

By backing ventures dedicated to ethical AI, investors help drive responsible tech innovation while tapping into the rising demand for personalized, value-driven experiences. Consider diversifying with AI-focused ETFs such as BOTZ.

5: For Job Seekers: Rise of AI personalization presents opportunities in various sectors. As companies increasingly adopt AI to tailor experiences, there is a growing need for skilled professionals who can design, implement, and manage these systems.

This includes roles for data scientists and AI specialists, experts in user experience, digital ethics, and compliance to ensure personalization algorithms are fair, transparent, and respectful of user privacy.

Therefore, individuals looking to advance their careers should consider developing expertise in these areas to be at the forefront of the AI personalization revolution. In AI literacy via Coursera’s AI for Finance specialization.

FAQs: Your AI Banking Questions Answered

Q1: Is AI in banking safe?

A: Yes, AI in banking employs advanced security protocols to safeguard financial data. Banks utilize encryption, fraud detection technologies, and real-time monitoring to ensure AI-driven processes remain secure and trustworthy.

Regulators are also setting standards to oversee AI systems and protect consumers. While AI enhances security, customers should stay vigilant and regularly check their account activity.

Q2: Can AI replace bankers?

A: AI is revolutionizing the banking industry by streamlining tasks like data analysis and customer support. However, it is unlikely to fully replace human bankers shortly. Human expertise and personal interaction remain essential for handling complex financial decisions and negotiations.

AI enhances efficiency and accuracy in banking operations, but ethical concerns and accountability in financial advice demand human oversight. Rather than replacing human expertise, AI complements it, excelling in repetitive tasks while humans stand out in empathy and complex problem-solving.

Q3: How does AI improve loan approvals?

A: AI is transforming banking by revolutionizing loan approvals with advanced algorithms that analyze vast amounts of data. It evaluates applicants’ credit history, income, spending habits, and other relevant factors, ensuring more accurate risk assessments and faster decision-making.

This transformation speeds up the approval process, reduces human error, and ensures loans are granted to those most likely to repay, safeguarding financial institutions’ assets. AI also analyzes non-traditional data, such as rent payments, to serve underbanked populations more effectively.

Q4: What happens if an AI makes a mistake?

A: Although AI systems are revolutionizing banking with remarkable efficiency, they are not perfect and can occasionally make errors. To address this, they are equipped with robust safeguards and adaptive learning capabilities to enhance their performance over time. When a mistake occurs, the system can be swiftly updated to rectify the issue and minimize the chances of it happening again.

Many financial institutions utilize a hybrid method that blends AI-driven insights with human supervision to improve precision. Additionally, EU regulations mandate that banks offer appeal mechanisms for algorithm-based decisions, promoting accountability as AI transforms the banking industry.

Q5: Will AI reduce banking fees?

A: AI is changing the banking sector by automating tasks and reducing manual efforts, potentially leading to lower banking fees. With reduced operational costs, banks might share these savings with their customers.

However, fee reductions depend on market competition and each bank’s goals. While automation lowers expenses, the costs of developing AI systems could delay these savings from reaching consumers.

Conclusion: The Future of Banking Hangs in the Balance

As the banking industry teeters on the precipice of a technological revolution, AI personalization will play a pivotal role in shaping its future. Banks that successfully harness the power of AI to offer personalized experiences will likely emerge as leaders, setting new standards for customer service and financial management.

Meanwhile, those that lag behind risk becoming obsolete, as tech-savvy consumers increasingly gravitate towards institutions that can provide tailored advice, predictive services, and a seamless user experience that aligns with their digital-first lifestyles.

AI offers unparalleled efficiency and innovation but risks exacerbating inequality and systemic risks. Banks must prioritize transparency, while customers should stay informed.

Call to Action:

- For Banks: The imperative is clear: embrace AI personalization responsibly. By doing so, financial institutions can foster a deeper sense of trust with their clientele. It is essential to implement AI solutions that are ethical and fair, ensuring that personalization does not come at the cost of privacy or equity.

- Banks must also inform their customers about the benefits and potential risks, empowering them to make informed decisions about their financial data and privacy.

- With the right approach, AI personalization can be a powerful tool to revolutionize the banking experience, making it more intuitive, responsive, and tailored to individual needs. Audit your AI systems today.

- For Readers: As the banking industry, AI personalization must be carried out with a keen eye on ethical considerations and data security.

- Banks that leverage AI to provide bespoke services, also maintain the highest data protection and transparency.

- Customers should clear options to control their data and understand how AI algorithms use their information to personalize their banking experience.

- By striking this balance, banks can build trust and foster stronger relationships with their clients, ensuring that personalization enhances service quality without compromising security or privacy.

- Share your AI banking experiences below. Have you been helped or harmed by algorithms?

Discussion Questions:

Stay Updated: AI personalization in banking is a double-edged sword that offers tailored financial advice and optimized customer experiences while raising concerns about the potential biases inherent in algorithmic decision-making.

As financial institutions increasingly rely on AI to make that affect people’s lives, the need for transparency and accountability becomes paramount.

We must establish robust ethical frameworks and oversight mechanisms to ensure that AI systems do not perpetuate existing inequalities but empower and provide equitable opportunities for all customers. Bookmark this article—we’ll revise it quarterly with the latest AI trends.

Additional Resources:

- Books: The AI Economy by Roger Bootle

- Tools: TensorFlow for custom AI models

- Courses: MIT’s AI in Financial Services on edX

Multimedia:

- Video: How AI Detects Fraud (YouTube)

- Interactive: Explore AI’s impact via Reuters’ Banking AI Simulator.