Navigating the Homebuying Process in California: A Friendly Guide for Professionals Aged 35+

Homebuying Process California

Purchasing a home in California can usually really feel akin to an exhilarating curler coaster trip, full with sudden twists and thrilling turns. But, there is no want to stress!

Whether your sights are set on that modern trendy apartment in the bustling metropolis of San Francisco or a captivating bungalow nestled in the serene neighborhoods of San Diego, this complete information is designed to assist you in navigating the homebuying process with ease and confidence.

Step 1: Get Your Finances in Order

Before embarking on the journey of home looking, it’s important to realize a complete understanding of your monetary state of affairs. Begin by guaranteeing your credit score is wholesome, as this can play a major function in your means to safe a mortgage with favorable phrases.

And, take the time to totally discover quite a lot of mortgage choices out there to you, permitting you to determine the one which finest aligns along with your monetary circumstances and future targets.

Quick Tip: Create a easy spreadsheet itemizing your month-to-month bills and financial savings targets. This will aid you decide how a lot home you may afford with out stretching your budget.

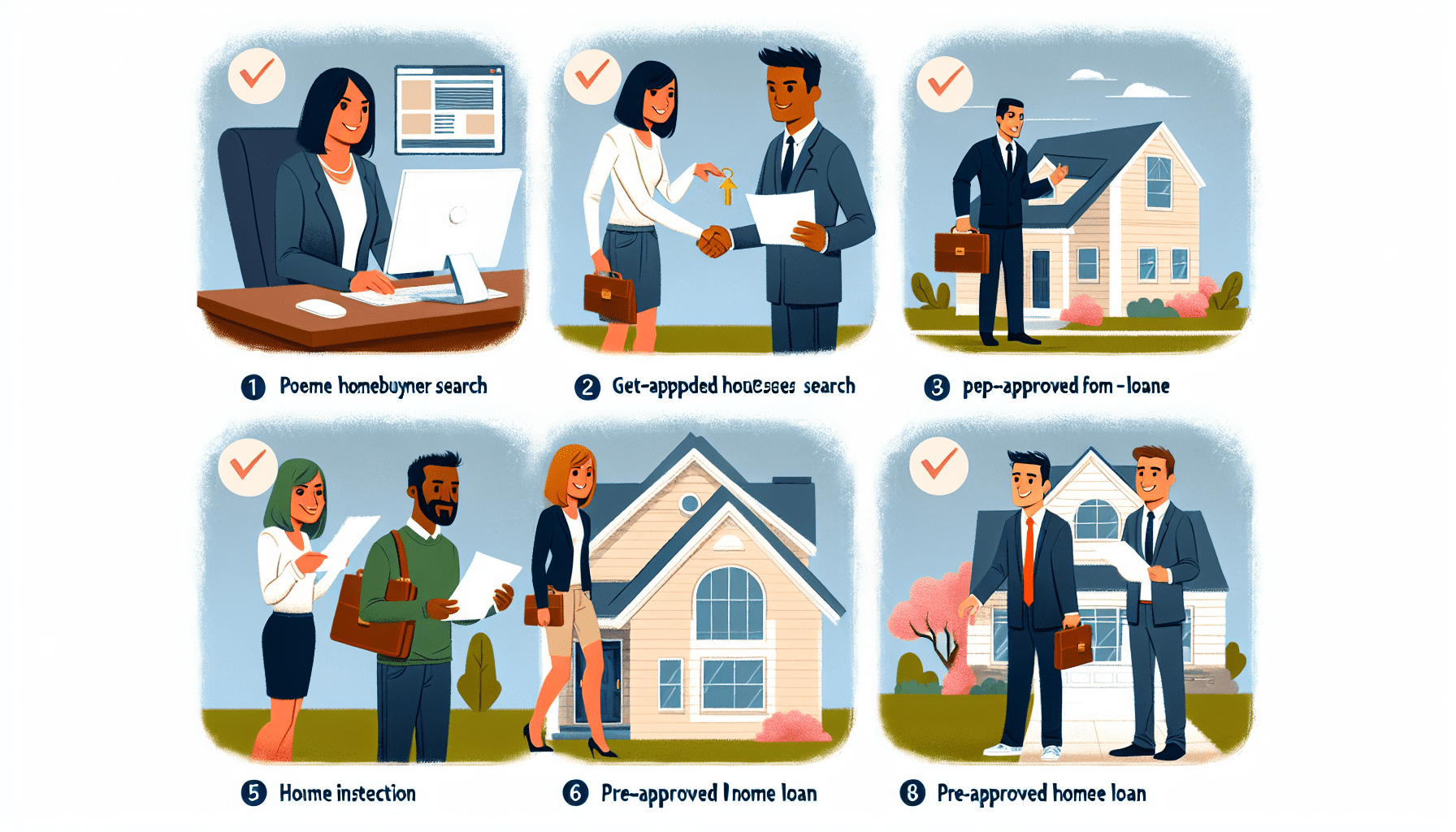

Step 2: Find the Right Real Estate Agent

An skilled and well-informed actual property agent can actually grow to be your best ally all through the homebuying journey. It’s necessary to hunt out an agent who possesses in-depth information of the native real estate market and has a eager understanding of your particular necessities and preferences.

Their experience can guide you in making informed decisions and discovering the excellent house that meets your wants.

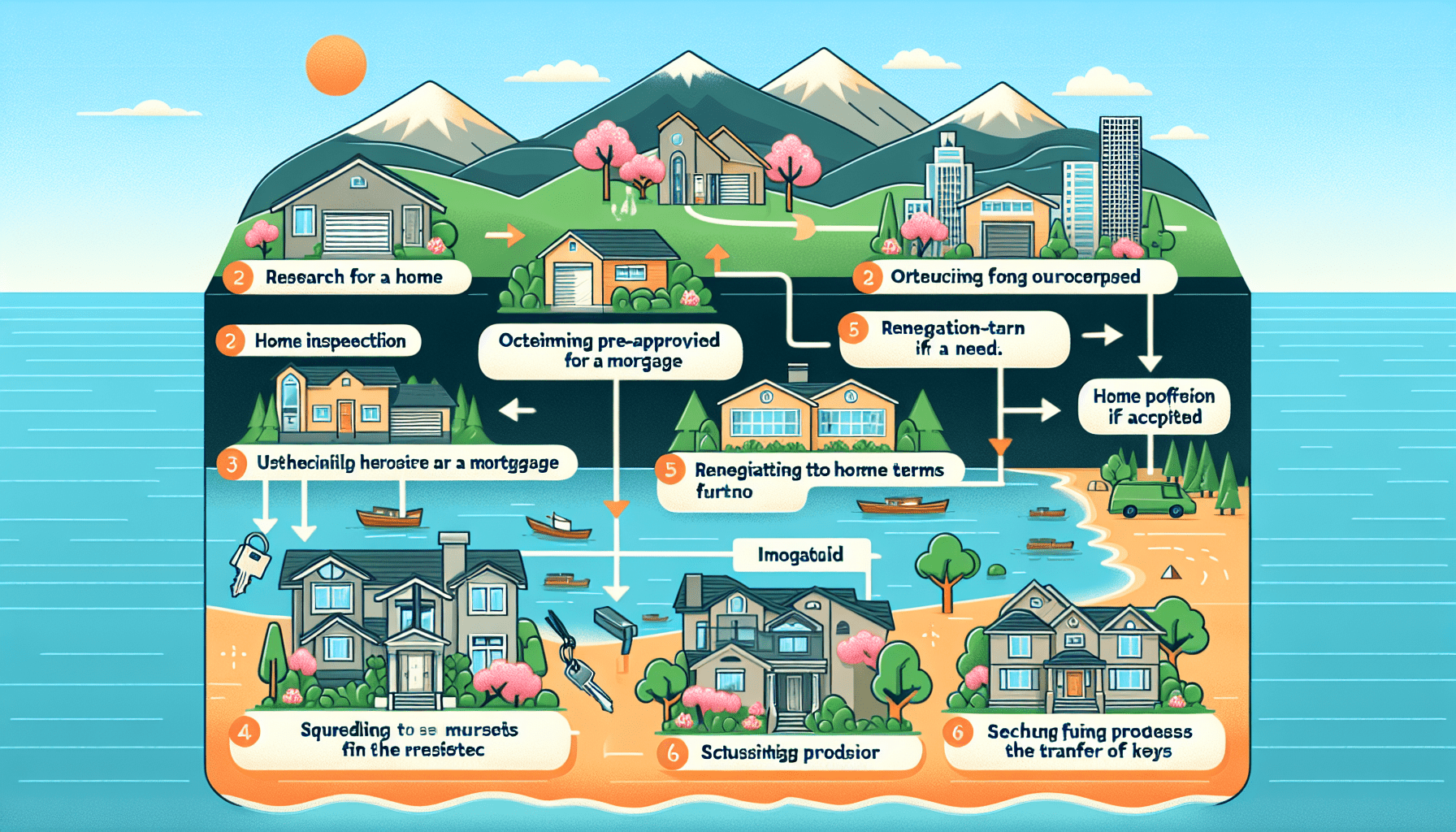

Step 3: Start Your Search

Now comes the thrilling section—home looking! Start by creating a comprehensive list of essential options and those who could be good to have.

This shall be instrumental in narrowing down your selections. It’s necessary to take into consideration the traits of the neighborhood, the length of your day by day commute and the availability of close by facilities, comparable to parks, outlets and colleges.

Anecdote: I as soon as had a shopper who was set on dwelling close to the ocean. After just a few viewings, they realized they valued a shorter commute extra. It’s all about discovering what actually issues to you.

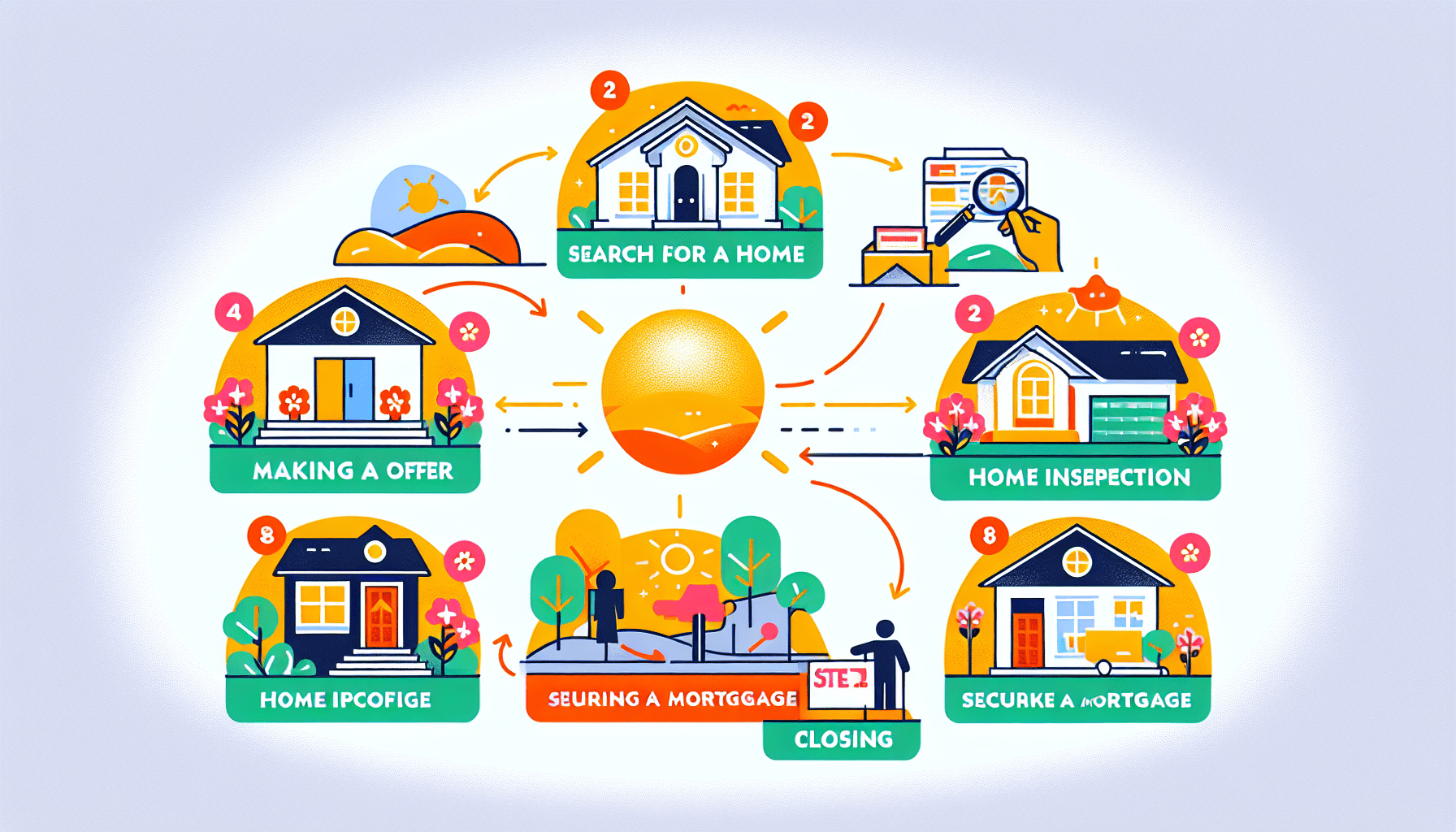

Step 4: Make an Offer

After discovering a home that really looks like house, it is the excellent second to proceed with making a proposal. Your actual property agent will help you in placing collectively a aggressive bid, guaranteeing that your provide stands out in the market.

They will information you thru the course of, considering present market traits and the particular situations of the property to extend your possibilities of securing your dream house.

Step 5: Home Inspections and Appraisals

Once your provide is accepted, it is essential to rearrange a complete house inspection to uncover any potential hidden points that will not be instantly seen. This step is important to making sure the property meets your expectations and requirements.

And, an appraisal shall be carried out to precisely assess the house’s market worth, offering you with a transparent understanding of its worth in the current real estate market.

Did You Know? California legislation requires sellers to reveal any recognized points with the property. This is a superb safeguard for patrons!

Step 6: Closing the Deal

Congratulations! You’re on the verge of turning into a home-owner! The closing course of is essential because it includes finalizing your mortgage preparations and signing a considerable quantity of paperwork. Your actual property agent shall be by your facet, guiding you thru each single step and guaranteeing you perceive every a part of the course of.

Interactive Element: Try utilizing a house affordability calculator to see how totally different interest rates can impression your month-to-month funds.

Final Thoughts

Buying a house in California doesn’t should be daunting. With the proper preparation and a little bit of patience, you’ll quickly discover the excellent place to name your individual.

External Links:

California Association of Realtors

Zillow Home Value Index

Keep in thoughts that staying knowledgeable with common updates on the newest market trends will ensure that your homebuying strategy remains effective and aggressive. Wishing you a profitable and fulfilling home looking expertise!

Originally posted 2025-01-02 15:47:02.