Understanding Property and Casualty Insurance: Comprehensive Insights and Practical Advice

What is property and casualty insurance?

Question: What exactly does property and casualty insurance coverage protection cover?

Understanding Property and Casualty Insurance: Comprehensive Insights and Practical Advice

Answer: Property and casualty insurance, often abbreviated as P&C insurance, is a broad category of coverage that primarily deals with the protection of physical assets and liability for actions that may cause injury or damage to others.

This type of insurance encompasses various policies, including homeowners insurance, automobile insurance, and liability insurance.

Essentially, it serves as a financial safety net, helping individuals and businesses to mitigate the risks associated with loss, theft, or damage to property, as well as legal liabilities that could arise from accidents or negligent acts.

Property and casualty insurance coverage protection is a broad class of safety designed to protect your belongings and defend you from obligation.

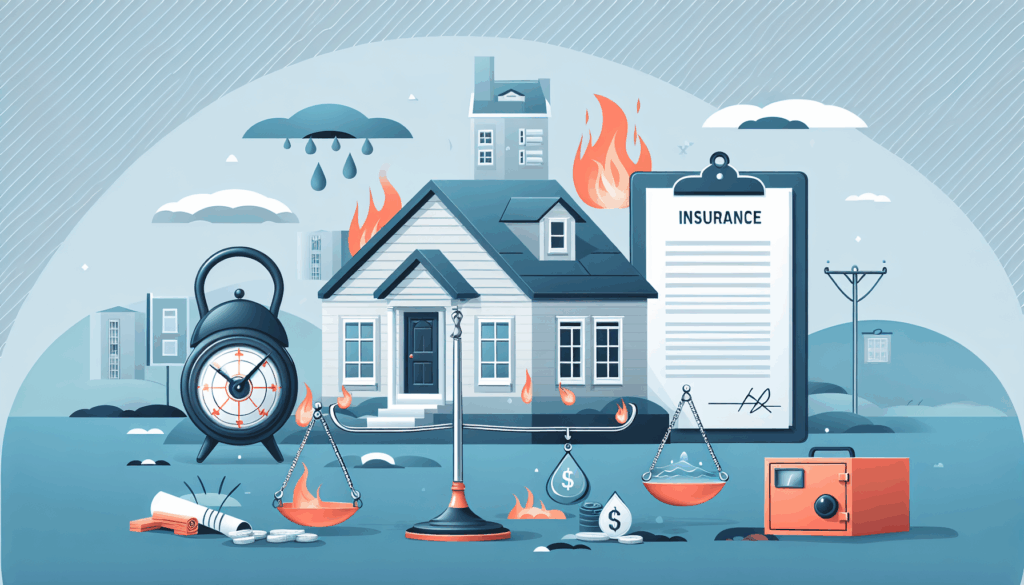

Property insurance coverage protection often covers damages to or loss of your property, equivalent to your non-public house or automobile, resulting from events like fire, theft, or pure disasters.

Casualty insurance coverage protection, alternatively, focuses on obligation safety, defending you in the event you are found legally liable for an accident that causes injury to others or damages their property.

Why Do You Need Property and Casualty Insurance?

Question: Why is it important to have property and casualty insurance coverage protection?

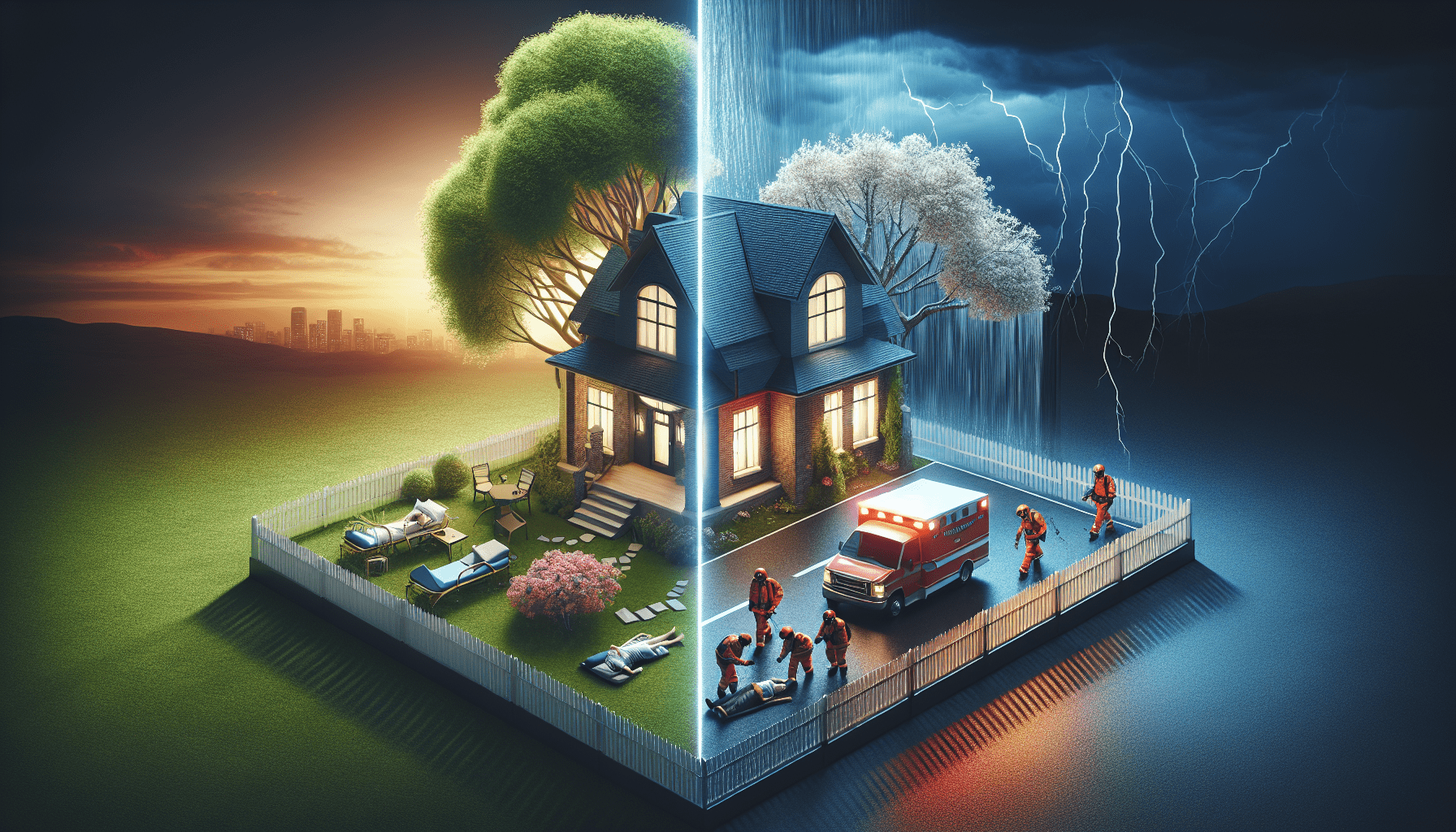

Answer: Property and casualty insurance provides a crucial safety net for individuals and businesses alike. Without it, you could be faced with insurmountable financial burdens should an accident occur on your property or as a result of your actions.

This type of insurance not only helps to cover the costs of damages and legal defenses, but it also offers peace of mind, knowing that you are protected against the unpredictable nature of life’s many risks.

Having property and casualty insurance coverage protection is crucial because it provides financial security in opposition to sudden events that may in some other case end in very important financial loss.

For example, if a hearth destroys your non-public house, property insurance coverage protection would possibly assist in covering the rebuilding costs.

Similarly, on the occasion you’re involved in an auto accident and found at fault, casualty insurance coverage protection can cover approved fees and compensation claims. This insurance coverage protection acts as a safety net, making sure that you’re not left financially devastated by sudden incidents.

How Do You Choose the Right Property and Casualty Insurance?

Question: What should I keep in mind when selecting property and casualty insurance coverage protection?

Answer: When considering property and casualty insurance, it’s essential to assess the value of your assets and the potential risks you face. Look for a policy that offers comprehensive coverage for your specific needs, whether it’s for your home, car, or business.

Additionally, compare premiums, deductibles, and the reputation of insurance providers to ensure you’re getting a fair deal with reliable service. When choosing a property and casualty insurance coverage protection, keep in mind the following parts:

1: Coverage Needs: Consider the value of your assets and the potential risks you may face. This will help you determine the level of coverage necessary to safeguard your property effectively. It’s crucial to assess whether you need additional protection for specific items or scenarios that may not be covered under a standard policy, such as flood or earthquake insurance.

Tailoring your coverage to match your circumstances can prevent costly gaps in protection and give you peace of mind. Assess what you will wish to defend, whether or not it’s your non-public house, vehicle, or enterprise, and ensure the protection covers these adequately.

2: Policy Limits: Policy Deductibles: When selecting an insurance policy, consider the deductible—the amount you’ll need to pay out of pocket before your coverage kicks in. A higher deductible can often lead to lower premium costs, but it’s essential to choose a level that you can comfortably afford in the event of a claim.

Weigh the potential savings in premiums against the financial impact of a larger upfront payment should an incident occur to ensure you’re making a balanced decision for your financial security. Understand the utmost amount the insurance coverage protection pays for a lined loss. Make sure the boundaries are ample to cover potential risks.

3: Deductibles: Consider the role of deductibles in your insurance policy. This is the amount you’ll pay out of pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums, but it’s crucial to choose a deductible that you can comfortably afford in the event of a claim.

Evaluate your financial situation to determine the right balance between deductible and premium costs to suit your budget and risk tolerance. Determine how much you might be eager to pay out-of-pocket sooner than the insurance coverage protection kicks in. The subsequent deductible usually means lower premiums.

4: Premium Costs: Coverage Options: When considering insurance, it’s crucial to assess the range of coverage options available to you. Look for policies that offer comprehensive protection for various scenarios that are relevant to your needs.

It’s important to read the fine print and understand the exclusions and limits of each policy, as these can significantly impact the effectiveness of your coverage when you need it most.

Always compare the benefits provided by different insurers to ensure you’re getting the best value for your investment in security and peace of mind. Compare premiums from completely different insurers to look for a fairly priced alternative without compromising on safety.

5: Insurer Reputation: Moreover, it’s crucial to delve into the insurer’s reputation and track record for reliability. Investigate customer reviews, ratings, and any awards or recognitions the company has received. This can offer insight into their customer service quality, claims handling efficiency, and overall satisfaction levels among policyholders.

By assessing the insurer’s standing in the industry, you can gauge their commitment to upholding high standards and ensuring a trustworthy partnership. Research the insurance coverage protection agency’s financial stability and buyer help report to ensure reliability while you wish to file a claim.

What Are Some Common Exclusions in Property and Casualty Insurance?

Question: What events or conditions are often not lined by property and casualty insurance coverage protection?

Answer: Exclusions in property and casualty insurance policies can vary widely, but there are some commonalities. Typically, these policies do not cover damages resulting from natural disasters such as floods or earthquakes unless specific coverage is added.

Additionally, intentional damage caused by the policyholder or normal wear and tear on a property is not covered.

It’s crucial for policyholders to thoroughly review their coverage details to understand the limitations and exclusions of their insurance policy. Common exclusions in property and casualty insurance coverage protection insurance coverage insurance policies would possibly embrace:

1: Flood Damage: Earthquake Damage: Just like flood damage, losses resulting from earthquakes are typically not covered under standard property insurance policies. Homeowners and businesses in areas prone to seismic activity should consider purchasing a separate earthquake insurance policy to safeguard their property.

Without this additional coverage, policyholders may find themselves facing significant financial burdens in the wake of an earthquake. Standard property insurance coverage typically does not cover flood damage; a separate flood insurance policy is usually required.

2: Earthquake Damage: To mitigate the financial impact of earthquake damage, property owners need to consider specialized earthquake insurance. This type of coverage is designed to provide compensation for losses due to seismic events, which can include structural damage to buildings, as well as personal property losses.

Without this targeted protection, the cost of repairs and replacements can be overwhelming, particularly in regions prone to frequent or high-magnitude earthquakes. Like floods, earthquakes often require further safety.

3: Wear and Tear: Earthquake insurance is designed to mitigate these financial burdens, ensuring that when the ground shakes, homeowners and businesses aren’t left to pick up the pieces alone.

It typically covers the cost of structural repairs, debris removal, and even the expenses associated with temporary relocation if the property is deemed uninhabitable.

By investing in a comprehensive earthquake insurance policy, property owners can gain peace of mind, knowing they have a safety net in place to protect their investments from the unpredictable forces of nature. Normal wear and tear or maintenance factors are often not lined.

4: Intentional Damage: Intentional damage, such as acts of vandalism or destruction caused by the property owner or others, is typically excluded from standard earthquake insurance coverage. This is because insurance is designed to protect against unforeseen events, not deliberate actions that could have been prevented.

Property owners must be vigilant in safeguarding their premises against such risks through security measures and proper management, as these acts can not only damage the property but also potentially void certain aspects of their insurance coverage. Damages prompted intentionally by the policyholder are excluded.

5: Business Activities: To mitigate the risks associated with business activities, companies must ensure that their insurance policies are comprehensive and tailored to their specific operational needs. This includes coverage for property damage, liability, and business interruption, which can safeguard against financial losses resulting from unforeseen events.

Furthermore, regular risk assessments can help identify potential vulnerabilities, allowing businesses to address these issues proactively and maintain a robust insurance strategy that aligns with their evolving risk profile. Personal property insurance coverage protection usually would not cover losses related to enterprise actions carried out from the dwelling.

How Can You Maximize the Benefits of Your Property and Casualty Insurance?

Question: What steps can I take to ensure I get probably the most out of my property and casualty insurance?

Answer: To maximize the benefits of your property and casualty insurance, it’s crucial to conduct an annual review of your policy. This ensures that your coverage is up-to-date with any changes in your life, such as major purchases or renovations that could affect the value of your insured assets.

Additionally, understanding the details of your policy, including the deductibles and limits, can help you make informed decisions about the level of risk you’re willing to accept and whether you need to purchase additional coverage to fill any gaps. To maximize your insurance coverage protection benefits:

1: Regular Reviews: Review your insurance policies regularly to ensure they remain in alignment with your current life circumstances. As your life evolves—whether through major life events like marriage, the birth of a child, purchasing a home, or starting a business—your coverage needs will likely change.

Staying proactive with annual or bi-annual policy reviews allows you to adjust your coverage, ensuring that you’re neither over-insured nor under-insured, which can save you money and prevent potential financial hardship in the future. Regularly analyze your protection to ensure it nonetheless meets your needs and alter safety as important.

2: Bundle Policies: Take Advantage of Discounts: Insurance companies often offer a variety of discounts that can significantly lower your premiums.

These can include discounts for having multiple policies with the same company, maintaining a good credit score, installing safety features in your home or vehicle, and demonstrating responsible behavior such as a clean driving record.

Always inquire about any available discounts and review your policies annually to make sure you’re taking full advantage of these cost-saving opportunities. Consider bundling different types of insurance (e.g., dwelling and auto) with the same provider to acquire reductions.

3: Risk Mitigation: Risk mitigation is a crucial step in managing your insurance costs effectively. By implementing safety measures and adhering to best practices, you can significantly reduce the likelihood of filing a claim. For instance, installing a home security system or using a vehicle with advanced safety features can lead to premium discounts.

Insurance companies often reward proactive measures that minimize risk, so it’s always beneficial to inform your insurer about any steps you’ve taken to safeguard your property and well-being. Take steps to mitigate risks, such as installing security systems or smoke detectors, which can result in lower premiums.

4: Accurate Valuation: Regular Policy Reviews: It’s crucial to periodically review your insurance policy to ensure it still aligns with your current needs and asset values. Over time, your property may increase in value or you might acquire new possessions that necessitate additional coverage.

By keeping your policy up to date, you can avoid being underinsured and ensure that you are paying for the protection that accurately reflects your situation. Keep an accurate inventory and valuation of your belongings to ensure they’re adequately insured.

5: Stay Informed: Regularly Review Your Coverage: It’s essential to periodically review your insurance policies to ensure they still meet your needs, especially after significant life events such as getting married, having a child, or making a major purchase. Changes in your circumstances or the marketplace can affect the amount and types of coverage you require.

By conducting an annual insurance review with your agent, you can discuss any changes in your life, adjust your coverage accordingly, and possibly even discover new discounts for which you may now be eligible. Stay updated on protection modifications or new safety selections that can benefit you.

Conclusion: Property and casualty insurance plays a vital role in safeguarding your financial well-being by protecting your assets and providing liability coverage. Understanding the scope of these policies, carefully selecting the right coverage, and staying informed about exclusions can help you avoid unexpected costs.

By regularly reviewing your insurance needs, bundling policies, and taking proactive steps to reduce risks, you can maximize the benefits of your coverage. Ultimately, having comprehensive property and casualty insurance offers peace of mind, ensuring you are prepared for life’s uncertainties and protected against potential financial setbacks.

Originally posted 2024-11-29 11:47:07.

I love the variety of topics covered on this blog.

This article really enlightened me on the subject, thank you for this detailed approach! By the way, if you’re looking for more great content, check out this site: https://insurancego.store/family-health-insurance-plans-2024/.

This article is both informative and enjoyable to read.

I find this blog really inspiring and well documented.

Your expertise in this field is impressive, thank you for this article! By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/investissement-et-trading-en-ligne/.

I will definitely be coming back to this site for more content like this.

Keep writing such interesting and relevant articles!

I didn’t expect to find so much useful information, thank you!

This site is a real resource of information, thank you very much! By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/developpez-votre-carriere-freelance/.

This is exactly what I needed to better understand this topic.

High quality content, very well explained!

Keep it up, it’s a real pleasure to read your articles. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/entreprise-rentable-sur-internet/.

Thanks for sharing this valuable content. Very well structured and easy to read!

I truly appreciate the clarity in your explanations. By the way, if you’re looking for more great content, check out this site: https://www.mostexpensive.store/from-art-to-automobiles/.

Your writing is really engaging, I was hooked from start to finish.

This site is now my reference for this kind of information. Excellent work! By the way, if you’re looking for more great content, check out this site: https://www.shortener.cloud/jack-ma/.

It’s a pleasure to read articles that are so well structured. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/maximiser-ses-revenus/.

Great article. I learned a lot of new things today. Thank you!

It’s so well written and so clear! I really enjoyed this post.

The way you explain this topic is really accessible, well done!

I truly appreciate the clarity in your explanations. By the way, if you’re looking for more great content, check out this site: https://www.aiearner.co/ai-data-analytics/.

You really have a unique way of approaching complex topics.

Keep sharing such valuable and well-structured content.

Thank you for these practical tips, they are easily applicable!

It’s always a pleasure to read your posts, keep it up!

Thank you for this comprehensive analysis, it was a great help to me. By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/strategic-asset-allocation/.

Keep sharing such valuable and well-structured content.

Your expertise shines through in every sentence, thank you for this post.

Thank you for all this clear and useful information.

This site is now my go-to for this kind of information. Great work! By the way, if you’re looking for more great content, check out this site: https://www.shortener.cloud/googles-humble-beginnings/.

Thank you for this article, it allowed me to better understand a complex subject.

Keep sharing such valuable and well-structured content. By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/mastering-liquidity-ratios/.

Thank you for this post! I love the way you make complex topics easy to understand.

A very relevant analysis, I appreciate your points of view.

I will not hesitate to come back to this blog to read your next articles.

I will definitely be coming back to this site for more content like this. By the way, if you’re looking for more great content, check out this site: https://www.mostexpensive.store/exclusive-handmade-home-goods-2024/.

I love this blog, keep posting these kinds of articles!

I love the variety of topics covered on this blog.

This site is now my reference for this kind of information. Excellent work! By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/understanding-the-market-approach/.

I didn’t expect to find so much useful information, thank you! By the way, if you’re looking for more great content, check out this site: https://www.aiearner.co/strategies-in-ai-coding/.

I highly recommend this blog to anyone interested in this topic.

Keep writing such interesting and relevant articles!

It’s always a pleasure to read your articles, keep it up!

This article is both informative and enjoyable to read.

An excellent resource, I appreciate the quality and clarity of the explanations.

It’s so well-written and clear! I really enjoyed this post.

I like the way you structure your articles, it makes it easier to read.

Well-structured content that gets straight to the point. Excellent work! By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/les-secrets-des-millionnaires/.

I am going to share this article with everyone who might be interested. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/seo-performant/.

This article was exactly what I was looking for. Thank you very much!

A very relevant analysis, I appreciate your points of view.