Time-Saving Small Business Accounting Hacks for 2025

Time-Saving Accounting Hacks

Hey there, fellow business owners! If you’re anything like me, you’re always on the hunt for ways to save time and keep your sanity intact. Accounting might not be the most thrilling part of running a small business, but it’s essential. So, let’s dive into some snappy accounting hacks that’ll make you feel like a wizard with a calculator in 2025!

Why You Need These Hacks

Time is money, especially in the realm of small businesses, where both are often scarce. Streamlining your accounting processes can free up precious time, allowing you to concentrate on what truly counts—growing your business and perhaps even enjoying a round of golf or two.

Hack #1: Automate Like a Pro

Remember the time when every transaction had to be entered by hand? Neither do I. With automation, your accounting software can handle the workload. Tools like QuickBooks and Xero can automatically import bank transactions, categorize expenses, and send invoices. It’s like having a tireless accounting assistant!

Hack #2: Go Paperless, Stay Organized

Mountains of paper receipts? No, thank you! Use apps like Expensify or Receipt Bank to snap pictures of your receipts and organize them digitally. Not only will you declutter your office, but you’ll also make tax time a breeze. Trust me, your accountant will thank you.

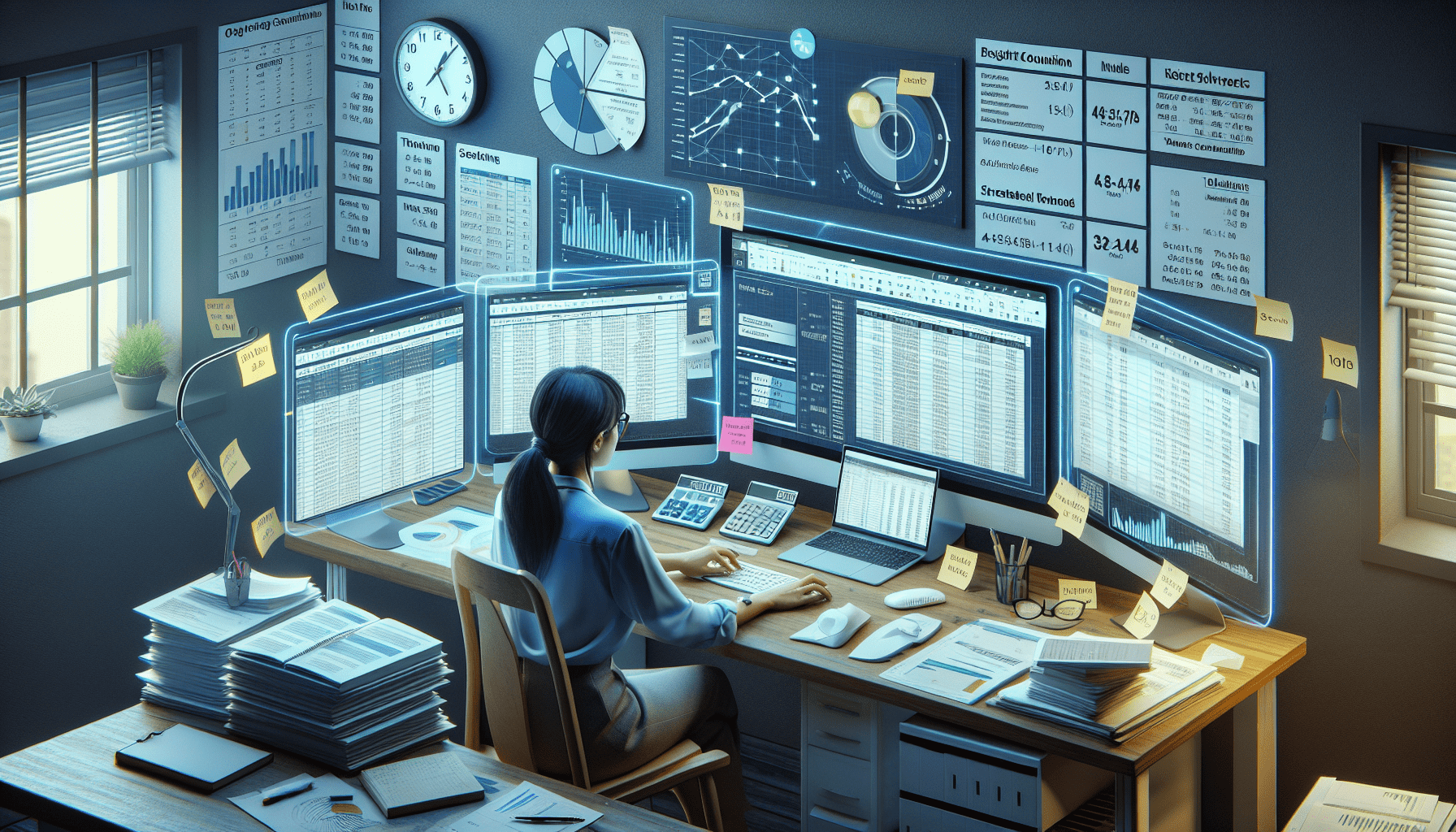

Hack #3: Implement a Real-Time Dashboard

Visual learners, unite! Create a real-time dashboard with tools like LivePlan or Fathom to see your financial health at a glance. Color-coded graphs and charts will help you track cash flow, expenses, and profits without breaking a sweat. Who knew accounting could be so colorful?

Hack #4: Schedule a Monthly Check-In

Dedicate time every month for a financial review. Enjoy a coffee, settle in, and explore your numbers. Identify trends, spot potential problems, and uncover growth opportunities. This habit keeps you informed and aids in making smart decisions. Plus, it’s a perfect reason to indulge in a fancy latte.

Hack #5: Outsource When Necessary

Often, the smartest strategy is recognizing when to delegate. Think about employing a virtual bookkeeper or accountant for tasks that sap your energy. Services like Bench or Bookkeeper360 provide cost-effective solutions that can save you time and reduce stress. Let’s face it, we could all benefit from a little less pressure in our lives.

Interactive Element: Accounting Quiz

Confident in your accounting skills? Test yourself with our quick quiz to see how you measure up!

- What’s the best way to categorize business meals?

- A) Personal expense

- B) Entertainment

- C) Business expense

- How often should you reconcile your bank statements?

- A) Monthly

- B) Quarterly

- C) Annually

FAQs: Quick Answers to Common Accounting Questions

Q1: How can I simplify my tax preparation?

A1: Keep detailed records and categorize expenses throughout the year. Use software like TurboTax to streamline the process.

Q2: What’s the best way to track my cash flow?

A2: Implement a cash flow management tool like Float or Pulse to monitor your inflows and outflows in real-time.

Real-Life Example: Jane’s Boutique Success Story

Meet Jane, owner of a thriving boutique. By automating her accounting and using a real-time dashboard, she reduced her monthly accounting workload by 30%! Now, Jane spends more time curating fabulous collections and less time buried in spreadsheets.

Final Thoughts

Adopting these small business accounting strategies in 2025 will save valuable time and give you a competitive edge. The aim is to work smarter, not harder. So, grab that coffee, automate processes, and see your business thrive!