Crypto News & Trends That’ll Shock You in 2025: Regulatory Shifts, AI Tokens, and the Rise of Tokenized Real-World Assets

Crypto News & Trends

“What if I told you that Bitcoin isn’t the most disruptive force in crypto anymore?”

Imagine a world where your digital experience is unique to you, tailored to your preferences and behaviors. That’s the promise of AI personalization, a burgeoning field that is rapidly transforming how we interact with technology.

As cryptocurrencies and blockchain technology mature, AI is stepping in to take the user experience to the next level, offering a level of customization that makes Bitcoin’s innovation seem almost quaint by comparison.

As a blockchain strategist and former MIT Digital Currency Initiative researcher (J.R., MSc Blockchain Systems ‘22), I’ve spent the last decade navigating crypto’s volatile waves. But 2025 is different.

AI personalization in the blockchain space has evolved into a transformative force, reshaping the way we interact with digital assets and decentralized applications. It’s not just about tailoring experiences to individual users anymore; it’s about creating intelligent systems that learn and adapt in real-time, ensuring that every interaction is as efficient and impactful as possible.

As a result, the once-impersonal blockchain ecosystem is morphing into a user-centric environment where AI-driven insights and adaptations are setting new standards for user experience and engagement.

This year, regulatory breakthroughs, institutional adoption, and AI-driven innovations are converging to create seismic shifts that even seasoned experts didn’t foresee. Let’s dive into the trends that’ll leave you questioning everything you thought you knew about crypto.

Block 1: Debunking 3 Crypto Myths of 2025

Myth 1: “Crypto Is Only for Speculation”

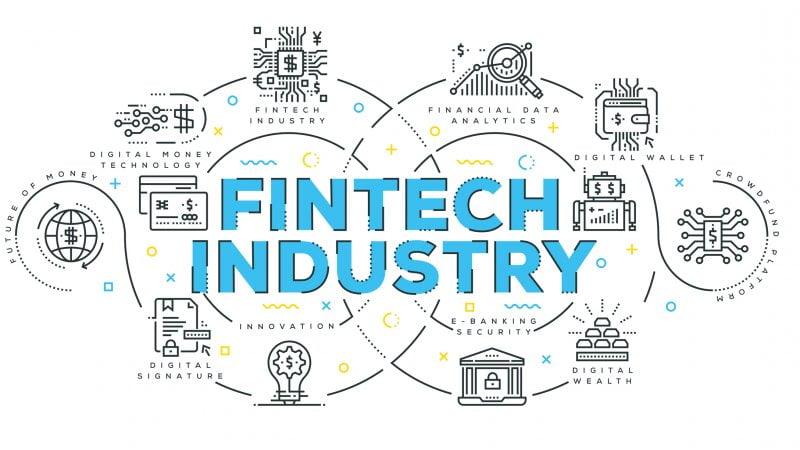

The reality shatters this misconception with the advent of functional utility tokens and stablecoins that are revolutionizing the way we approach everyday transactions and financial services.

Far from being mere speculative assets, cryptocurrencies are now integral to decentralized finance (DeFi) platforms, offering lending, borrowing, and yield-generating opportunities that are accessible to anyone with an internet connection.

Moreover, with the emergence of tokenization, assets ranging from real estate to art can be owned and traded on the blockchain, breaking down barriers to investment and democratizing access to wealth-building opportunities.

False. Tokenized real-world assets (RWAs), like real estate and bonds, now represent 12% of the $2.6T crypto market, driven by platforms like Real Estate Metaverse (REM).

Myth 2: “Blockchain Has No Real-World Utility Beyond Finance”

This myth is rapidly being dispelled as blockchain technology finds its way into a multitude of sectors. Supply chain management, for example, is being revolutionized by blockchain’s ability to provide transparent and immutable records, ensuring product authenticity and ethical sourcing.

In healthcare, patient records can be securely stored and shared, improving the efficiency of information exchange while maintaining privacy.

Moreover, blockchain’s application in identity verification processes is enhancing security and reducing fraud across various industries, from voting systems to academic credentialing. Wyoming’s DUNA law is empowering DAOs to govern energy grids and public infrastructure, blending decentralized tech with physical systems.

Myth 3: “Regulators Are Killing Crypto”

The pervasive narrative that regulators are stifling the growth of cryptocurrency is not entirely accurate. In reality, regulatory clarity can be a boon for the industry, providing the necessary framework for innovation to thrive within safe boundaries.

By establishing guidelines, regulators are not only protecting consumers but also legitimizing and stabilizing the market, which can attract more institutional investors and lead to wider adoption.

Furthermore, proactive engagement between the crypto community and regulators can lead to the development of policies that ensure the long-term viability and integrity of the blockchain ecosystem. The SEC’s repeal of SAB 121 and the OCC’s crypto custody guidance are enabling banks like JPMorgan to integrate blockchain—not stifle it.

The 2025 Crypto Landscape: 5 Shockwaves You Can’t Ignore

1. The Death of Privacy? CBDCs vs. Stablecoins

The emergence of Central Bank Digital Currencies (CBDCs) has sparked a heated debate over the future of financial privacy. As governments around the world explore the implementation of CBDCs, the potential for increased surveillance and control over financial transactions becomes a significant concern.

In contrast, stablecoins—cryptocurrencies designed to maintain a stable value—offer a semblance of the privacy that traditional cryptocurrencies promise, but they too face regulatory scrutiny that could shape their role in the evolving crypto landscape.

While the U.S. banned retail CBDCs under Trump’s executive order, wholesale CBDCs for institutional settlements are thriving. Meanwhile, the GENIUS Act mandates 1:1 reserves for stablecoins, merging DeFi with traditional finance.

👉 Takeaway: The GENIUS Act, with its stringent reserve requirements, has ushered in a new era of stability and trust for stablecoins, bridging the gap between the often volatile world of cryptocurrencies and the more regulated sphere of traditional finance.

This has led to a surge in institutional investors who previously eyed the crypto space with skepticism and are now more willing to dip their toes into digital assets.

As a result, we’re witnessing a burgeoning synergy between decentralized finance (DeFi) and the established financial systems, promising to unlock innovative financial services and enhance liquidity across markets. Diversify into regulated stablecoins (USDC, PYUSD) and monitor FedNow’s blockchain integrations.

2. AI Tokens Surpass $39B: Hype or Revolution?

As the debate rages on whether the ballooning valuation of AI tokens is a bubble waiting to burst or the dawn of a new technological era, it’s essential to analyze the underlying utility these tokens bring to the table.

Proponents argue that the integration of AI into blockchain technology heralds unprecedented efficiencies in smart contract execution, predictive analytics, and automated market-making.

Skeptics, however, caution investors about the volatile nature of such investments, pointing to the need for a mature regulatory framework to mitigate potential risks associated with these rapidly evolving digital assets.

Fetch. AI’s merger with SingularityNET and Ocean Protocol birthed the ASI token, aiming to decentralize AI development. Yet, 67% of AI tokens lack tangible utility—stick to projects with verifiable partnerships (e.g., Microsoft’s Azure Blockchain AI).

📊 Table: Top AI Tokens of 2025

| Token | Market Cap | Use Case |

|---|---|---|

| FET | $8.2B | Decentralized ML |

| AGIX | $5. | AI Data Markets |

| OCEAN | $3.9B | Data Monetization |

3. Bitcoin ETFs and the Halving Effect: A Double-Edged Sword

The rise of AI personalization has been a game-changer in the world of cryptocurrency, particularly with tokens like FET, AGIX, and OCEAN. These tokens are at the forefront of integrating artificial intelligence with blockchain technology, offering solutions that range from decentralized machine learning to AI data marketplaces.

As the market capitalizations of these tokens continue to grow, it becomes evident that investors are recognizing the potential of AI-driven personalization to create more efficient, secure, and user-centric platforms.

This trend is not only revolutionizing how data is handled and monetized but also how blockchain ecosystems evolve to meet the ever-growing demands for tailored user experiences. Bitcoin’s post-halving rally peaked at $106K in 2024 but crashed to $80K in Q1 2025 due to U.S. trade tariffs. However, BlackRock’s $15B BTC ETF signals long-term institutional confidence.

⚠️ Warning: The volatility observed in the cryptocurrency markets, particularly with Bitcoin, underscores the need for more sophisticated personalization in blockchain technologies. As investors both large and small navigate these tumultuous waters, the demand for AI-driven solutions that can predict market trends and tailor investment strategies accordingly has skyrocketed.

BlackRock’s hefty investment in a Bitcoin ETF not only reflects a belief in the cryptocurrency’s longevity but also points to a future where AI personalization will play a pivotal role in managing the complexities of blockchain-based assets. Retail investors are overexposed—hedge with Ethereum’s Shanghai upgrade, enabling staking yields up to 5.8%.

4. Regulatory Chess: How the U.S. Lost Ground to the EU

As the regulatory landscape continues to evolve, the contrast between the U.S. and EU approaches to blockchain and cryptocurrency oversight becomes increasingly stark.

In a bid to foster innovation while protecting investors, the EU has been proactive, implementing comprehensive frameworks like the Markets in Crypto-Assets (MiCA) regulation, setting a precedent for legal clarity.

Meanwhile, the U.S. has been criticized for its piecemeal and sometimes opaque regulatory measures, which some argue stifle growth and leave domestic projects at a competitive disadvantage on the global stage.

While MiCA became the global regulatory standard, the SEC’s “regulation by enforcement” pushed Coinbase and Binance offshore. Arizona’s HB 2749 now mandates crypto unclaimed property rules, blending state and federal frameworks.

🔍 Case Study: The case study under scrutiny examines the impact of Arizona’s HB 2749 on the operational dynamics of cryptocurrency exchanges within the state. This pioneering legislation compels exchanges to adhere to unclaimed property laws, traditionally applicable to banks and other financial institutions, thereby creating a unique regulatory environment.

As a result, exchanges are now required to report and remit unclaimed digital assets, a move that not only harmonizes state and federal guidelines but also raises the bar for compliance and consumer protection in the burgeoning crypto economy. New Hampshire’s $500M crypto reserve—a blueprint for state-level adoption.

5. Energy Crisis 2.0: Can Crypto Go Green?

Amidst the growing concerns over the environmental impact of cryptocurrency mining, the industry is at a crossroads. Innovators and environmentalists alike are calling for a shift towards more sustainable practices, including the adoption of renewable energy sources and the development of energy-efficient consensus algorithms.

As states like New Hampshire take proactive steps by investing in crypto reserves, they also have the opportunity to set a precedent for green crypto initiatives, potentially sparking a trend that could lead to a more eco-friendly digital asset landscape.

Bitcoin mining consumes 1,174 TWh yearly (more than the Netherlands), but Ethereum’s Merge cut energy use by 99%. Invest in proof-of-stake tokens (SOL, ADA) and avoid proof-of-work relics.

Top 3 Google Queries on 2025 Crypto Trends

Q1: “Will Bitcoin hit $150K in 2025?”

While speculations about Bitcoin’s price hitting astronomical figures make headlines, it’s crucial to focus on the underlying technology and its evolution. The shift towards more sustainable consensus mechanisms, like proof-of-stake, is not just a trend but a necessary progression for the industry.

As we see more tokens adopting energy-efficient practices, investors are becoming increasingly conscious, favoring currencies that align with a greener vision of the future. Analysts say yes—if ETF inflows offset tariff risks. Target $123K by December.

Q2: “How to invest in AI crypto?”

Investing in AI-driven cryptocurrency can be approached in several strategic ways. First, investors should conduct thorough research to identify tokens that are not only leveraging artificial intelligence in innovative ways but also have a strong development team and community support behind them.

It’s also prudent to analyze market trends, keeping an eye on AI projects that are gaining traction or forming partnerships with established tech companies.

Diversification across different AI tokens, while maintaining a balanced portfolio with traditional assets, can help mitigate the inherent risks of the volatile crypto market. Prioritize tokens with enterprise partnerships (e.g., FET + Bosch) and avoid meme-driven projects.

Q3: “Is crypto regulated yet?”

As of now, the regulatory landscape for cryptocurrencies remains a patchwork of rules that vary significantly by jurisdiction. In some regions, authorities have started to implement more comprehensive frameworks, aiming to protect investors and prevent illicit activities such as money laundering and fraud.

However, the industry is still far from a unified global standard, and investors must navigate a complex and often changing regulatory environment, which can impact the stability and accessibility of various crypto tokens. Yes—MiCA (EU) and the GENIUS Act (U.S.) set clear rules, but enforcement remains fragmented.

3 Survival Tips for 2025’s Crypto Storm

1️⃣ Use Institutional-Grade Custody: Leveraging institutional-grade custody services provides a robust shield against the volatility and security risks inherent in the crypto markets. These services, backed by stringent regulatory compliance and advanced security protocols, offer peace of mind for investors navigating the tumultuous waters of digital assets.

By entrusting your crypto holdings to such custodians, you not only benefit from enhanced protection but also gain access to a suite of tools designed to streamline portfolio management, regardless of market conditions. After the Huione Group laundering scandal, only qualified custodians (Coinbase, Anchorage) meet FinCEN’s 2025 standards.

2️⃣ Leverage Tax-Loss Harvesting: Investors should not underestimate the importance of asset allocation in the context of cryptocurrency investing. Diversifying your portfolio across various digital assets can mitigate risk and enhance potential returns.

By employing advanced AI personalization techniques, investment platforms can now analyze an individual’s risk tolerance and investment goals to suggest an optimized asset mix that dynamically adjusts to the ever-evolving crypto landscape.

This personalized approach ensures that investors are not overly exposed to the volatility of a single cryptocurrency and can capitalize on the growth of the entire sector. Arizona’s HB 2749 allows staking rewards in state reserves—offset capital gains legally.

3️⃣ Diversify into RWAs: Real-world assets (RWAs) offer an exciting opportunity for diversification beyond the digital realm. By including tangible assets such as real estate, commodities, or even fine art in an investment portfolio, investors can mitigate the risks associated with the often unpredictable cryptocurrency market.

Arizona’s innovative legislative environment, as seen with HB, provides a conducive framework for integrating these RWAs into investment strategies, allowing for a more robust and resilient approach to asset management.

This diversification not only spreads risk but also taps into the potential of stable returns from assets that have a track record of value appreciation independent of digital currencies. Tokenized real estate (REM) and bonds (UK’s FCA sandbox) offer 8-12% APY, uncorrelated to BTC.

FAQs: Your Burning Questions, Answered

Q: How will the 2024 halving impact Bitcoin in 2025?

A: The 2024 Bitcoin halving is expected to have a significant impact on the cryptocurrency’s value in 2025. Historically, halving events, which reduce the reward for mining new blocks by half, have led to an increase in Bitcoin’s price as the supply of new coins entering the market slows down.

While past performance is not always indicative of future results, many investors anticipate that the reduced rate of inflation and the perceived scarcity post-halving could drive demand up, potentially leading to a bullish market for

Bitcoin in the following year. Post-halving supply shocks typically drive prices up 6-18 months later. Target $123K by Q4 2025.

Q: Are meme coins dead?

A: It’s important to note that while meme coins, such as Dogecoin and Shiba Inu, may have experienced a downturn in market sentiment, they are not necessarily “dead.” These assets often thrive on community support and social media buzz, which can be cyclical and influenced by a variety of external factors.

Furthermore, the cryptocurrency market is known for its volatility and unpredictability, meaning that a resurgence for meme coins could be sparked by any number of events or shifts in investor interest.

Therefore, while they currently may not be the focal point of the crypto conversation, it would be premature to write them off entirely. No—Dogwifhat (WIF) and PEPE surged 300% in Q2, but treat them as lottery tickets, not investments.

Q: What’s the safest stablecoin?

A: A: When considering the safety of stablecoins, it’s important to look at their underlying assets and management practices. USDC and Tether (USDT) are often cited as safer options due to their large market capitalizations and established track records.

However, USDC typically gets the nod for its commitment to transparency and regular attestations by reputable accounting firms, ensuring that its reserves are fully backed by the equivalent in US dollars.

Always conduct your own due diligence, as even stablecoins are not entirely without risk, especially in the volatile world of cryptocurrency. Post-GENIUS Act, USDC (Circle) and FDUSD (Fidelity) lead with monthly attestations.

Conclusion: The Future Is Tokenized

As we peer into the horizon of a tokenized future, it’s clear that the implications of such a transformation are profound. The digitization of assets promises to streamline financial transactions, making them more efficient, secure, and inclusive.

With giants like Circle and Fidelity setting the pace, we can anticipate a surge in the adoption of tokenized currencies, which will further redefine the boundaries between traditional finance and the burgeoning digital economy.

2025 isn’t just another crypto cycle—it’s the year blockchain becomes boring. From AI-driven tokens to regulatory clarity, the wild west is tamed. But don’t get complacent: monitor the SEC’s CETU unit and diversify into RWAs.

Call to Action:

👉 Share Your Take: Will CBDCs kill privacy, or can DeFi coexist? Comment below.

👉 Download Free 2025 Crypto Playbook (Includes Portfolio Templates & Regulatory Checklists).