Unlocking the Secrets of Corporate Restructuring: A Guide for the Curious Mind

Hey there, business explorer! So, you’ve heard the term “corporate restructuring” tossed around and thought, “What’s all the buzz about?” Well, grab a coffee, and let’s unravel this intriguing topic together. Imagine corporate restructuring as a makeover for companies—like when you decide it’s time to swap out your old wardrobe for something fresh and snazzy. Sounds fun, right? Let’s dive in!

What is Corporate Restructuring?

Corporate restructuring is like giving a company a facelift. It involves significant changes to a company’s structure, operations, or finances. Think of it as a strategy to boost performance, tackle financial challenges, or seize new opportunities. Like deciding to switch up your workout routine to achieve your fitness goals, companies restructure to align better with their objectives.

Types of Corporate Restructuring

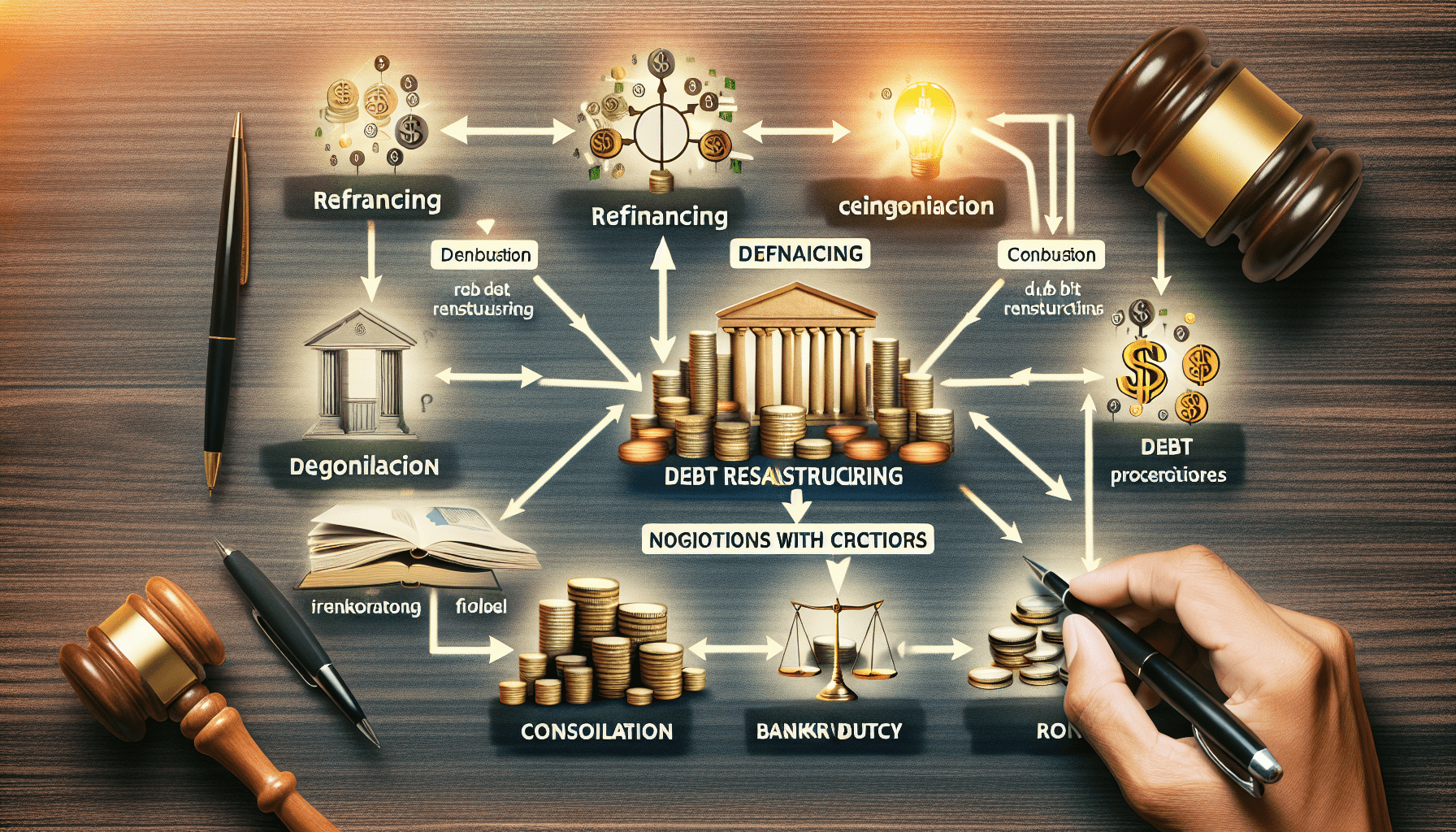

- Financial Restructuring

- What’s It About? Adjusting the financial setup, like debt arrangements and capital structure. It’s kind of like refinancing your mortgage when interest rates drop.

- Example: Remember the financial crisis of 2008? Many banks restructured to stay afloat.

- Organizational Restructuring

- What’s It About? Changing the company’s internal setup, such as management hierarchies or departmental layouts. Consider it the corporate equivalent of rearranging your living room furniture.

- Example: When Nokia shifted focus from mobile phones to network infrastructure.

- Mergers and Acquisitions (M&A)

- What’s It About? Combining with another company or buying it. It’s like when two superhero teams join forces to fight a common enemy.

- Example: Disney’s acquisition of Pixar, which brought us a new era of animated magic.

- Divestitures and Spin-offs

- What’s It About? Selling off parts of a company or creating a new independent company. Imagine splitting a pizza to share with friends—everyone gets a piece.

- Example: eBay spinning off PayPal to let it grow independently.

- Cost Restructuring

- What’s It About? Streamlining operations to cut costs, like canceling that gym membership you never use (no judgment!).

- Example: When General Motors restructured to reduce operational costs post-2008.

Fun Facts and Tips

- Did You Know? According to Wikipedia, restructuring can also involve legal and technological changes.

- Tip: Always keep an eye on the market trends. Just like you wouldn’t wear winter boots in summer, companies need to adapt to stay relevant.

Interactive Element: Restructuring Quiz

Question: What type of restructuring involves selling off parts of a business?

- A) Financial Restructuring

- B) Divestitures

- C) M&A

Answer: B) Divestitures

Real-Life Case Study: IBM’s Transformation

IBM’s transition from hardware manufacturing to a focus on cloud computing and AI is a classic restructuring tale. By shedding its old business lines and investing in new technology, IBM reinvented itself as a leader in the tech industry.

FAQs

Q: Why do companies restructure?

A: Companies restructure to improve efficiency, address financial challenges, or capitalize on new market opportunities.

Q: Is restructuring always successful?

Not always. Like trying a new recipe, it can fail if not executed properly. Success depends on planning, timing, and market conditions.

Q: How does restructuring affect employees?

A: It can lead to changes in roles, redundancies, or new opportunities, much like switching teams in a company.

External Links for Further Reading

- Harvard Business Review on Organizational Restructuring

- McKinsey & Company’s Insights on Financial Restructuring

Final Thoughts

Just like every great movie has a plot twist, corporate restructuring is a turning point for companies seeking a fresh start. It’s like finding a new path when the old one doesn’t lead where you want to go. Whether it’s financial tweaks or organizational overhauls, restructuring can breathe new life into a corporation.

So, next time you hear about a company restructuring, you’ll know it’s not just business jargon—it’s a strategic step to stay ahead in the game. Now, go impress your friends with your newfound knowledge!